Tag Small Cap Stocks

The recent market volatility – the tale of the perfect storm

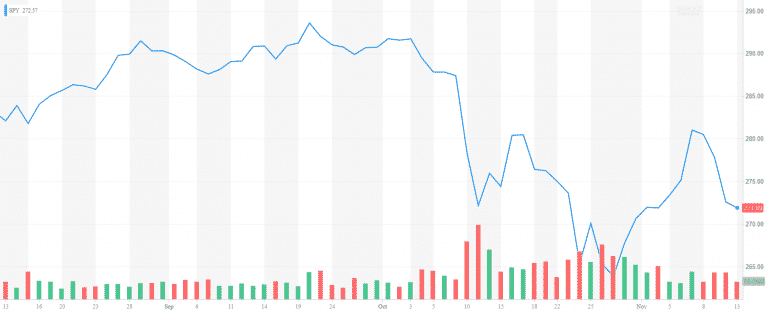

The recent market volatility – the tale of the perfect storm October is traditionally a rough month for stocks. And October 2018 proved it. S&P 500 went down -6.9% in October after gaining as much as 10.37% in the first…

Market Outlook October 2018

Overview The US stock market was on an absolute tear this summer. S&P 500 went up by 7.65% and completed its best 3rd quarter since 2013. Despite the February correction, the US stocks managed to recover from the 10% drop. All…

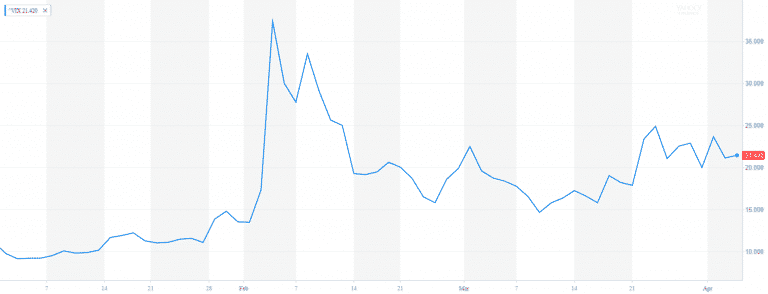

Market Outlook April 2018

Market Outlook April 2018 After a record high 2017, the volatility has finally returned. Last year the market experienced one of the highest risk-adjusted performances in recent history. In 2017 there were only 10 trading where the S&P 500 moved…

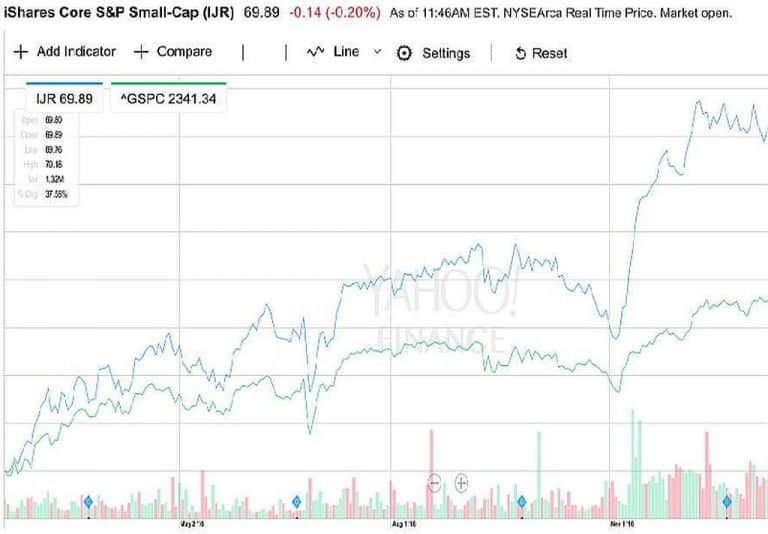

Will Small Caps continue to rally under Trump Presidency?

Small Cap stocks are a long-time favorite of many individual investors and portfolio manager. The asset class jumped 38% since the last election. Will Small Caps continue to rally under Trump Presidency? Can they maintain their momentum? The new president Trump…

Investing in Small Cap Stocks

Small cap stocks are an important part of a diversified investment portfolio. They had provided high historical return and diversification, which are key factors in the portfolio management process. Many flagship companies started as small businesses in a local market…

Contact Us