Smart 401(k) moves to make in 2025

Smart 401(k) moves to make in 2025 to grow your retirement savings. Your 401(k) is one of the most effective vehicles for building long-term wealth, and the choices you make today can shape your financial future. As we step into 2025, now is the ideal moment to fine-tune your strategy. Here are six smart moves to help you make the most of your 401(k) and accelerate your retirement readiness.

Smart 401(k) strategies can make a significant difference in how quickly your retirement savings grow. If you’re contributing to a 401(k), now is the perfect time to reassess your approach and ensure you’re maximizing every available benefit. In this article, we’ll walk through six strategic moves that can help you strengthen your retirement plan and build long-term financial security.

What is a 401(k) plan?

A 401(k) is a workplace retirement plan that helps employees save for the future. It’s convenient and practical because both you and your employer can contribute. You can set up automatic payroll deductions and choose how much of your salary goes into the plan. Most 401(k)s offer several investment options, including stocks, bond funds, and ETFs. Many employers also provide a matching contribution. In most cases, you must participate in the plan to receive the match.

1. Maximize your 401(k) contributions in 2025

Maximizing your 401(k) contributions each year is one of the smartest ways to boost your retirement savings.

Did you know that in 2025, you can contribute up to $23,500 to your 401(k) plan? If you are 50 or over, you are eligible for an additional catch-up contribution of $7,500.

Employees who are 60, 61, 62, and 63 years old are eligible for a higher catch-up contribution of $11,500 in 2025

Traditional 401 (k) contributions are tax-deductible and will lower your overall tax bill in the current tax year.

Many employers offer a 401(k) match, which is free money for you. The only way to receive the match is to participate in the plan. If you cannot max out your contribution, try to deduct the highest possible percentage to capture the entire employer match. For example, if your company offers a 4% match on every dollar, you should contribute at least 4% to get the whole match.

How can you reach $1 million in your 401(k) by age 65?

Do you want to reach $1 million in your 401(k) by retirement? The secret recipe is to start early. For example, if you are 25 years old today, you only need to set aside $387 per month for 40 years, assuming a 7% annual return. If you are 35, your saving rate increases to $820 per month. If you start in your 50s, you must save about $3,000 a month to reach $1 million.

401(k) Contributions by Age

| Age | | | Monthly Contribution | Yearly Contribution | Lifetime Contribution | ||

| 25 | $387 | $4,644 | $190,404 | |||

| 30 | $560 | $6,720 | $241,920 | |||

| 35 | $820 | $9,840 | $305,040 | |||

| 40 | $1,220 | $14,640 | $380,640 | |||

| 45 | $1,860 | $22,320 | $468,720 | |||

| 50 | $3,000 | $36,000 | $576,000 | |||

| 55 | $5,300 | $63,600 | $699,600 |

2. Review your investment options.

Most 401(k) plans offer a range of investment options, typically including mutual funds, index funds, and target-date funds. It’s essential to review these options periodically to ensure they align with your retirement goals, risk tolerance, and market conditions.

When did you last review the investment options inside your 401(k) plan? When was the last time you made any changes to your fund selection? With automatic contributions and investing, it is easy to get things on autopilot. But remember, these are your retirement savings. Now is the best time to get a grip on your 401 (k) investments.

Look at your fund performance over the last 1, 3, 5, and 10 years and make sure the fund returns are near or higher than their benchmark. Review the fund fees. Check whether new funds have been added to the lineup recently.

What is a Target Date Fund?

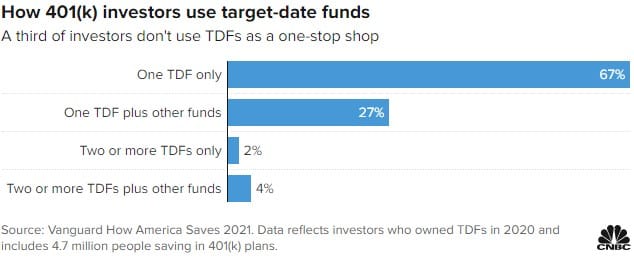

A target-date fund is an age-based retirement fund that automatically adjusts your stock and bond investment allocation as you approach retirement. Young investors allocate more to equities, which are considered riskier assets. In comparison, investors approaching retirement receive a bigger share in safer investments such as bonds. By design, plan participants should choose one target-date fund, set it, and forget it until they retire. The fund will automatically adjust its asset allocation as you approach your retirement age.

However, a recent study by Vanguard found that nearly 33% of 401(k) plan participants misuse their target-date funds. A third of TDF owners combine them with another fund.

3. Change your asset allocation

Changing your asset allocation is a key strategy to balance risk and reward in your 401(k). Asset allocation tells you how your investments are spread between stocks, bonds, money markets, and other asset classes. Stocks are typically riskier but offer strong earnings potential. Bonds are considered a safer investment but provide a limited annual return.

Your ideal asset allocation depends on your age, investment horizon, risk tolerance, and specific individual circumstances.

Typically, younger plan participants have a longer investment horizon and can withstand portfolio swings to achieve higher returns in the future. If you are one of these investors, you can choose a higher stock allocation in your 401(k).

However, if you are approaching retirement, you will have a much shorter investment horizon and probably a lower tolerance to investment losses. In this case, you should consider adding more bonds and cash to your asset allocation.

4. Consider contributing to a Roth 401(k) in 2025

Are you concerned about paying higher taxes in the future? A Roth 401(k) can help you manage that risk.

With a Roth 401(k), you make contributions after paying your federal and state income taxes.

This means you do not get a tax break today.

However, the long-term benefit can be significant.

All the money you invest has the potential to grow tax-free. If you keep your funds in the account until retirement, or until you reach age 59½, you can withdraw your earnings without paying any taxes.

This can give you more control over your income in retirement and help reduce your overall tax burden later in life.

A Roth 401(k) is especially useful for young professionals. You may be in a lower tax bracket today, so paying taxes now may cost you less. It is also a strong option if you expect your future tax rate to be higher.

For many people, a Roth 401(k) offers a valuable alternative to the traditional, tax-deferred 401(k) and can help create more tax flexibility in retirement.

5. Do a Mega backdoor 401(k) conversion

The Mega Backdoor 401(k) is a strategy that allows high-income earners to contribute extra money to a Roth account through their 401(k) plan. It combines after-tax contributions with an in-plan Roth conversion, giving you the potential to grow retirement savings tax-free.

Many high earners cannot make direct Roth contributions due to income limits. At the same time, they may prefer traditional tax-deferred 401(k) contributions to reduce their current taxable income. The Mega Backdoor 401(k) allows you to have the best of both worlds: tax-deferred savings today and tax-free growth in the future.

There is one key requirement: your 401(k) plan must allow after-tax contributions and support in-plan Roth conversions. Not all plans offer this feature, so it’s important to check with your HR or plan administrator.

For 2025, the total 401(k) contribution limit—including tax-deferred, Roth, after-tax contributions, and employer match—is $70,000. If you are 50 or older, the limit rises to $77,500. Employees aged 60–63 have an even higher catch-up limit of $81,500 in 2025.

Here’s how the strategy works:

- Maximize standard contributions and employer match. This ensures you get all available tax-deferred benefits and free money from your employer.

- Make after-tax contributions up to the total annual limit. These contributions do not reduce your taxable income, but they allow you to save significantly more.

- Execute an in-plan Roth conversion. This moves your after-tax contributions into a Roth account, where all future earnings grow tax-free. Without this conversion, any gains on your after-tax contributions would be taxable upon withdrawal.

When used correctly, the Mega Backdoor 401(k) can dramatically increase your retirement savings and give you a valuable source of tax-free income in the future.

6. Rollover an old 401(k) plan in 2025

Do you have an old 401(k) sitting with a former employer? Many people forget about these accounts and rarely check their balances. Over time, this can lead to lost opportunities and poor investment oversight. Rolling over an old 401(k) into a Rollover IRA can be a wise decision.

A rollover gives you complete control of your retirement savings. You no longer have to rely on your former employer’s plan or its limited investment menu. With a Rollover IRA, your investment choices expand dramatically. You can choose from a wide range of stocks, bonds, ETFs, and other investment options. This flexibility can help you build a portfolio that better matches your goals, risk level, and timeline.

If you want more control and more choices, a Rollover IRA may be a strong next step.

Conclusion

Maximizing your 401(k) in 2025 requires thoughtful planning and regular check-ins. By increasing your contributions, adjusting your asset allocation, exploring Roth options, and rolling over old accounts, you can strengthen your long-term retirement strategy.

A financial advisor can help you tailor these steps to your own goals and circumstances.

With the right approach, your 401(k) can become one of your most powerful tools for building financial security in retirement.

Contact Us