10 Behavioral biases that can ruin your investments

As a financial advisor, I often speak with my clients about behavioral biases. Our emotions can put a heavy load on our investment decisions. In this article, I would like to discuss ten behavioral biases that I encounter every day. It’s not a complete list, but it’s a good starting point to understand your behavioral biases and how to deal with them.

We have to make choices every day. Often our decisions are based on limited information or constrained by time. We want to make the right call every single time. But sometimes we are wrong. Sometimes we can be our worst enemy. Stress, distraction, media, and market craziness could get the worst of us.

Behavioral finance

In 2018 Richard Thaler won the Nobel prize for his work in behavioral economics. In his 2009 book “Nudge” and later on in his 2015 book “Misbehaving: The Making of Behavioral Economics,” Thaler reveals the architecture of the human decision-making process. He talks about behavioral biases, anomalies, and impulses that drive our daily choices.

In another study about the value of the financial advisor or the advisor alpha, Vanguard concluded that clients using a financial advisor have the potential to add 1.5% of additional annual returns as a result of behavioral coaching. Further on, Vanguard concludes that because investing evokes emotion, advisors need to help their clients maintain a long-term perspective and a disciplined approach.

Afraid to start investing

Social Security is going into deficit by 2035. And most employers moving toward Defined Contribution Plans (401k, 403b, SEP-IRA). It will be up to you and me to secure our retirement by increasing our savings and investments. However, not everybody is in tune. For many people, investing is hard. It’s too complicated. Not all employers provide adequate training about retirement and investment options. And I don’t blame anyone. As much as I try to educate my blog readers, as well as many colleagues, we are outnumbered by the media and all kinds of financial gurus without proper training and credentials. If you are on the boat and want to start investing, talk to a fiduciary financial advisor, or ask your employer for educational and training literature. Don’t be afraid to ask hard questions and educate yourself.

“This time is different.”

How many times have you heard “This time is different” from a family member or the next financial guru, who is trying to sell you something? Very likely, it’s not going to be any different. As a matter, it could be worse. As humans, we tend to repeat our mistake over and over. It’s not that we don’t learn from our mistakes. But sometimes it’s just more comforting staying on your turf, not trying something new, and hoping that things will change. So, when you hear “This time is different,” you should be on high alert. Try to read between the lines and assess all your options.

Falling for “guaranteed income” or “can’t lose money” sales pitch

As many people are falling behind their retirement savings, they get tempted to a wide range of “guaranteed income” and “can’t lose money” financial products. The long list includes but not limited to annuities, life insurance products, private real estate, cryptocurrency, and reverse mortgage. Many of these products come with sky-high commissions and less than transparent fees, costly riders, and complex restrictions and high breakup fees. The sales pitch is often at an expensive steakhouse or a golf club following a meeting in the salesperson’s office where the deals are closed. If someone is offering you a free steak dinner to buy a financial product that you do not fully understand, please trust me on it – you will be the one picking the tab in the end.

Selling after a market crash

One of the most prominent behavioral biases people make in investing is selling their investments after a market crash. As painful as it could be, it’s one of the worst decisions you could make. Yes, markets are volatile. Yes, markets crash sometimes. But nobody has made any money panicking. You need to control your impulses to sell at the bottom. I know it’s not easy because I have been there myself. What really helps is thinking long-term. You can ask yourself, do you need this money right away. If you are going to retire in another 10 or 20 years, you don’t need to touch your portfolio, period. Market swings are an essential part of the economic cycle. Recessions help clean up the bad companies with a poor business model and ineffective management and let the winners take over.

You may remember that the rise of Apple coincided with the biggest recession in our lifetime, 2008 – 2009. Does anyone still remember Blackberry, Nokia, or Motorola, who were the pioneers of mobile phones?

Keeping your investments in cash

Another common behavioral bias is keeping your investments in cash…..indefinitely. People who keep their 401k or IRA in cash almost always miss the market recovery. At that point, they either have to chase the rally or must wait for a market correction and try to get in again. As a financial advisor, I would like to tell you that it is impossible to time exactly any market rally. By the time you realize it. It’s already too late.

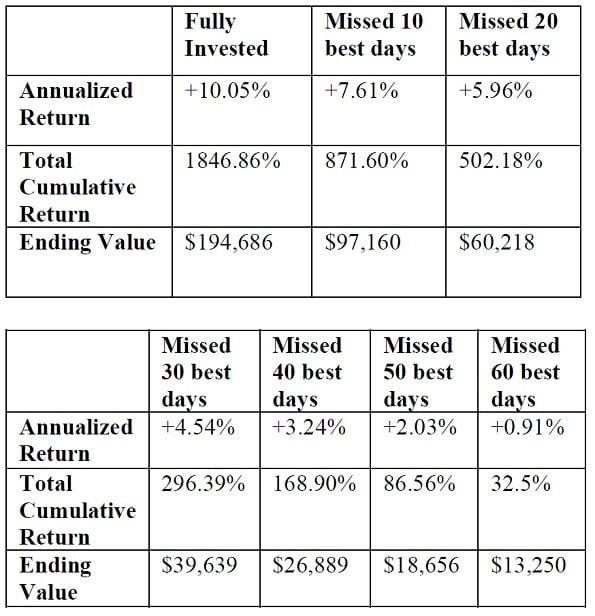

To understand why timing the markets and avoiding risk by keeping cash can be harmful, see what happens if an investor misses the biggest up days in the market. The hypothetical table below looks at the performance of $10,000 invested in the S&P 500 between January 4, 1988, and December 31, 2018. It’s important to note this hypothetical investment occurred during two of the biggest bear markets in history, the 2000 tech bubble crash and the 2008 global financial crisis.

As you can see, missing the ten best days over between 1998 and 2018 meant earning nearly 2.5% less on an annual basis and leaving half of the potential absolute gains on the table. Here’s the kicker: Six of the 10 “best days” in the market were within weeks of the worst days in the market. In other words, some of the best days often happen as “v-shaped” bounces off the worst days. Going to cash on a big negative day means increasing the risk of missing a big positive day which, as can be seen from the table above, can have a substantial impact on your returns over time.

Chasing hot investments

One of the most common behavioral biases is chasing hot investments. People generally like to be with the winners. It feels good. It pumps your ego. There is a whole theory of momentum investing based on findings that investors buy recent winners and continue to buy their stock for another 6 to 12 months. We have seen it time and time again – from the tech bubble in 2000, through the mortgage-backed securities in 2008, to cryptocurrency and cannabis stocks in 2018. People like highflyers. Some prior hot stocks like Apple, Google, and Amazon dominate the stock markets today. Others like Motorola, Nokia, and GE dwindle in obscureness. If an investment had a considerable run, sometimes it’s better to let it go. Don’t chase it.

Holding your losers too long

“The most important thing to do if you find yourself in a hole is to stop digging.” – Warren Buffett.

In a research conducted in the 1990s by professor Terrance Odean, he concluded that investors tend to hold to their losers a lot longer than their winners. A result of this approach, those investors continue to incur losses in the near future. Professor Odean offers a few explanations for his findings. One reason is that investors rationally or irrationally believe that their current losers will outperform. A second explanation comes from the Prospect Theory by Kahneman and Tversky (1979). According to them, investors become risk-averse about their winners and risk-seeking to their losers.

When it comes to losing bets, they are willing to take a higher gamble and seek to recover their original purchase price. A third theory that I support and observed is based on emotions. The pain from selling your losers is twice as high as the joy from selling your winners. We don’t like to be wrong. We want to hold on to the hope that we made the right decision. After all, it is a gamble, and the odds will be against you. At some point, we just need to make peace with your losses and move on. It’s not easy, but it’s the right thing to do.

Holding your winners too long

There is a quote by the famous financier Bernard Baruch – “I made my money by selling too soon.” Many people, however, often hold on to their winners for very long. Psychologically, it’s comforting to see your winners and feel great about your investment choices. There is nothing wrong with being a winner. But at some point, you must ask yourself, is it worth it. How long this run can go for and should you cash in some of your profits. What if your winners are making up a large part of your investment portfolio? Wouldn’t this put your entire retirement savings at risk if something were to happen to that investment?

There is no one-size-fits-all answer when it comes to selling your winners. Furthermore, there could be tax implications if you realize the gains in your brokerage account. However, it’s prudent to have an exit strategy. As much as it hurts (stops the joy) to sell the winners, it could lower the risk of your portfolio and allow you to diversify amongst other investments and asset classes.

Checking your portfolio every day

The stock market is volatile. Your investments will change every day. There will be large swings in both directions. So, checking your portfolio every single day can only drive crazy and will not move the needle. It could lead to irrational and emotional decisions that could have serious long-term repercussions. Be patient, disciplined, and follow your long-term plan.

Not seeking advice

Seeking advice from a complete stranger can be scary. You must reveal some of your biggest secrets to a person you never met before. It’s s big step. I wish the media spends more time talking about the thousands of fiduciary advisors out there who honestly and trustworthy look for your best interest.

My financial advisory service is based on trust between you as a client and me as the advisor . So, do not be afraid to seek advice, but you also need to do your homework. Find an advisor who will represent you and your family and will care about your personal goal and financial priorities. Don’t be afraid to interview several advisors before you find the best match for you.

Final words

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.” – Warren Buffet.

Investing is an emotional act. We put our chips on the table and wish for a great outcome. We win, or we lose. Understanding your emotions and behavioral biases will help you become a better investor. It doesn’t mean that we will always make the right decisions. It doesn’t mean that we will never make a mistake again. We are humans, not robots. Behavioral biases are part of our system. Knowing how we feel and why feel a certain way, can help us when the markets are volatile, when things get ugly or the “next big thing” is offered to us. Look at the big picture. Know your goals and financial priorities. Try to block the noise and keep a long-term view.

Reach out

If you have questions about your investments and retirement savings, reach out to me at st****@***********th.com or +925-448-9880.

You can also visit my Insights page, where you can find helpful articles and resources on how to make better financial and investment decisions.

About the author:

Stoyan Panayotov, CFA, MBA is a fee-only financial advisor in Walnut Creek, CA, serving clients in the San Francisco Bay Area and nationally. Babylon Wealth Management specializes in financial planning, retirement planning, and investment management for growing families, physicians, and successful business owners.

Subscribe to get our newest Insights delivered right to your inbox

Latest Articles

Contact Us