Category Investing 101

Investing during election and how to beat uncertainty

Investing during election years often brings market uncertainty due to the potential for policy shifts. This uncertainty can prompt some investors to hold cash, fearing volatility, while others stay fully invested. Based on historical trends, market behavior, and investment principles,…

Where to invest your money in 2023?

Where to invest your money in 2023? The last few years have been a rollercoaster for stock and bond investors. First, we had to deal with covid lockdowns and supply chain disruptions. Then came the war in Ukraine and the…

Bear market bottom and 10 sign to help you recognize it

A bear market bottom is often elusive and hard to identify. Every investor dreams of timing the stock market bottom and consistently buying low and selling high. But in reality, catching the bear market bottom is hard, even for experienced…

Cash is king and stocks are on sale

The stock market certainly feels like a rollercoaster these days. We had a strong finish in 2021, but almost everything went downhill from there, except for oil and inflation It has been a while since I wrote a mid-year market…

Ten Successful tips for surviving a bear market

Surviving a bear market can be a treacherous task even for experienced investors. If you are a long-term investor, you know that the bear markets are common. Since 1945, there have been 14 bear markets—or about every 5.4 years. Experiencing…

5 reasons to leave your robo-advisor and work with a real person

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage…

Successful strategies for (NOT) timing the stock market

Timing the stock market is an enticing idea for many investors. However, even experienced investment professionals find it nearly impossible to predict the daily market swings, instant sector rotations, and ever-changing investors’ sentiments. The notion that you can perfectly sell…

Understanding Tail Risk and how to protect your investments

What is Tail Risk? Tail Risk is the possibility of suffering large investment losses due to sudden and unforeseen events. The name tail risk comes from the shape of the bell curve. Under normal circumstances, your most likely investment returns…

Investment ideas for 2020

Investment ideas for 2020 and beyond. Learn what trends will drive the stock market in the next decade. Disruption creates opportunity 2020 has been challenging in multiple ways. The global pandemic changed our lives. We have adapted rapidly to a…

Navigating the market turmoil after the Coronavirus outbreak

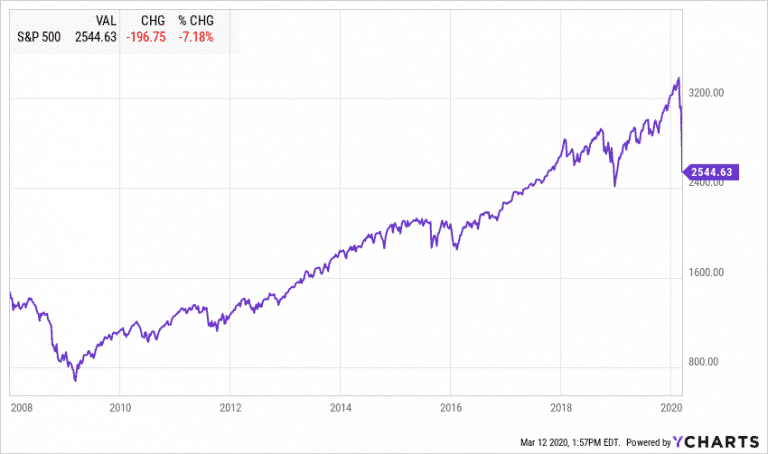

Here is how to navigate the market turmoil after the Coronavirus outbreak, the stock market crash, and bottom low bond yields. The longest bull market in history is officially over. Today the Dow Jones recorded its biggest daily loss since…

Top 5 Dividend Growth ETFs

Dividend growth ETFs offer a convenient and diversified way to invest in companies that consistently grow their dividends. Certainly, dividend-paying stocks provide a predictable stream of cash flows to investors looking for extra income. Companies that steadily grow their dividends year…

How to Survive the next Market Downturn

Everything you need to know about surviving the next market downturn: we are in the longest bull market in US history. After more than a decade of record-high stock returns, many investors are wondering if there is another market downturn…

10 Behavioral biases that can ruin your investments

As a financial advisor, I often speak with my clients about behavioral biases. Our emotions can put a heavy load on our investment decisions. In this article, I would like to discuss ten behavioral biases that I encounter every day.…

Why negative interest rates are bad for your portfolio

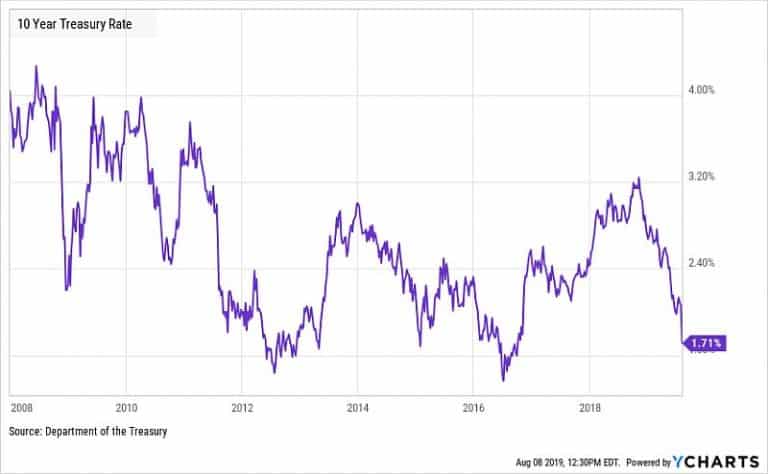

Quantitative Easing Ever since the financial crisis of 2008-2009, central banks around the world have been using lower interest rates and Quantitative Easing (QE) to combat to slow growth and recession fears. In the aftermath of the Great Recession, all…

The Rise of Momentum Investing

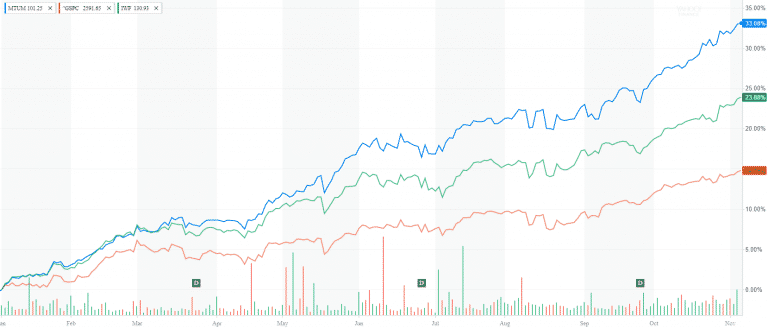

The Rise of Momentum Investing While the momentum theory has been around for two decades, we had to wait until 2017 to see the rise of momentum investing. The largest momentum ETF (MTUM) is up 35% YTD. And unless something…

Will Emerging Markets Continue to Rally

Will Emerging Markets Continue to Rally Emerging Markets are up 26% so far year. But can they sustain the rally? If you invested in one of the large EM ETFs like EEM (iShares MSCI Emerging Markets ETF) or VWO (Vanguard…

5 Myths and One True Fact about passive investing

The passive investing in ETFs and index funds has experienced a massive influx of money in the past ten years. The US ETF market is quickly approaching $3 trillion in assets under management. As of March 29, 2017, the total…

Everything you need to know about your Target Retirement Fund

Target Retirement Funds are a popular investment option in many workplace retirement plans such as 401k, 403b, 457, and TSP. They offer a relatively simple and straightforward way to invest your retirement savings as their investment approach is based on…

6 Essential steps to diversify your portfolio

Diversification is often considered the only free lunch in investing. In one of my earlier blog posts, I talked about the practical benefits of diversification. I explained the concept of investing in uncorrelated asset classes and how it reduces the…

Top 5 Strategies to Protect Your Portfolio from Inflation

Protecting Your Portfolio from Inflation The 2016 election revived the hopes of some market participants for higher interest rates and higher inflation. Indeed, the 10-year Treasury rate went from 1.45% in July to 2.5% in December before settling at around…

Contact Us