Category Investing 101

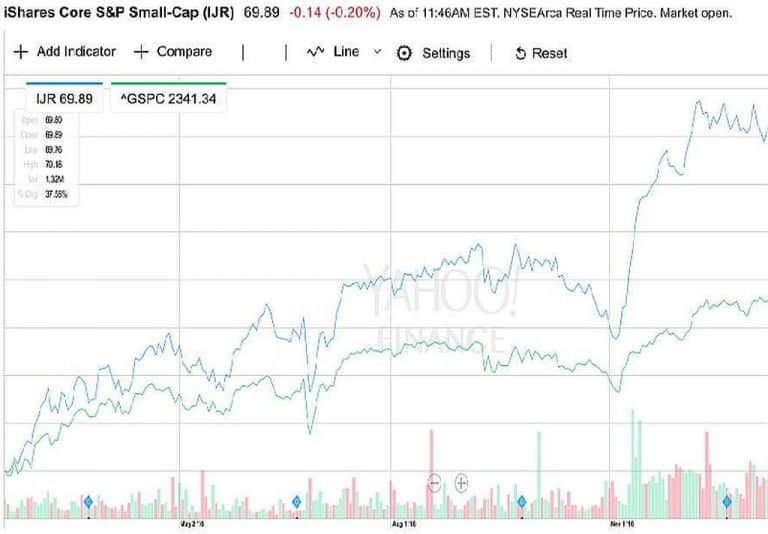

Will Small Caps continue to rally under Trump Presidency?

Small Cap stocks are a long-time favorite of many individual investors and portfolio manager. The asset class jumped 38% since the last election. Will Small Caps continue to rally under Trump Presidency? Can they maintain their momentum? The new president Trump…

Municipal Bond Investing

What is a Municipal Bond? Municipal bond investing is a popular income choice for many Americans. The muni bonds are debt securities issued by municipal authorities like States, Counties, Cities, and related businesses. Municipal bonds or “munis” are issued to…

10 Ways to reduce taxes in your investment portfolio

Successful practices to help you lower taxes in your investment portfolio A taxable investment account is any brokerage or trust account that does not come with tax benefits. Unlike Roth IRA and Tax-Deferred 401k plans, these accounts do not have many…

Introduction to portfolio diversification

Introduction Portfolio diversification is one of the main pillars of retirement planning. The old proverb “Never put all your eggs in one basket” applies in full strength to investing. Even the Bible talks about diversification. Ecclesiastes 11:2 says “Divide your portion…

Contact Us