Ten Successful tips for surviving a bear market

Surviving a bear market can be a treacherous task even for experienced investors. If you are a long-term investor, you know that the bear markets are common. Since 1945, there have been 14 bear markets—or about every 5.4 years. Experiencing a bear market is rough but an inevitable aspect of the economic cycle.

What is a bear market?

A bear market is a prolonged market downturn where stocks fall by 20% or more. Often, bear markets are caused by fears of recession, changes in Fed policy, political uncertainty, geopolitics, or poor macroeconomic data. There have been 26 bear markets in the S&P 500 Index since 1928. However, there have also been 27 bull markets—and stocks have risen significantly over the long term. The average length of a bear market is 289 days or about 9.6 months. For comparison, the average length of a bull market is 991 days or 2.7 years.

A bear market doesn’t necessarily indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time. Bear markets often go alongside a slowing economy, but a weakening market doesn’t necessarily mean an imminent recession.

How low can stock go down during a bear market?

Historically, stocks lose 36% on average during a bear market. For comparison, stocks achieve a 114% return on average during a bull market.

The largest-ever percentage drop by the S&P 500 index occurred on October 19, 1987 (known as The Black Monday), when the S&P 500 dropped by -20.47%. The next biggest selloff happened on October 15, 2008, when the S&P 500 lost –9.03%. In both cases, the stock market continued to be volatile for several months before reaching a bottom. Every time, the end of the bear market was the start of a new bull market. Both times, the stock market recovered and reached historic highs in a few years.

What can you do in the next bear market?

The first instinct you may have when during a sharp market drop is to sell your investments. In reality, this may not always be the right move. Selling your stocks during a bear market could limit your losses but also lead to missed long-term opportunities. Emotional decisions do not bring a sustainable long-term outcome.

Dealing with declining stock values and market volatility can be challenging. The truth is nobody likes to lose money. The bear markets can be treacherous for seasoned and inexperienced investors alike. To be a successful investor, you must remain focused on the strength of your portfolio, your goals, and the potential for future growth. I want to share ten strategies that can help you survive the next bear market and preserve the long-term growth of your portfolio.

1. Stay calm during a bear market

Although it can be difficult to watch your stock portfolio decline, it’s important to remember that bear markets have always had a temporary role in the investment process. Those who survive the bear market and make it to the other side can reap huge benefits.

It’s normal to be cheerful when the stock prices are going higher. And it’s even more natural to get anxious during severe bear markets when stocks are going down.

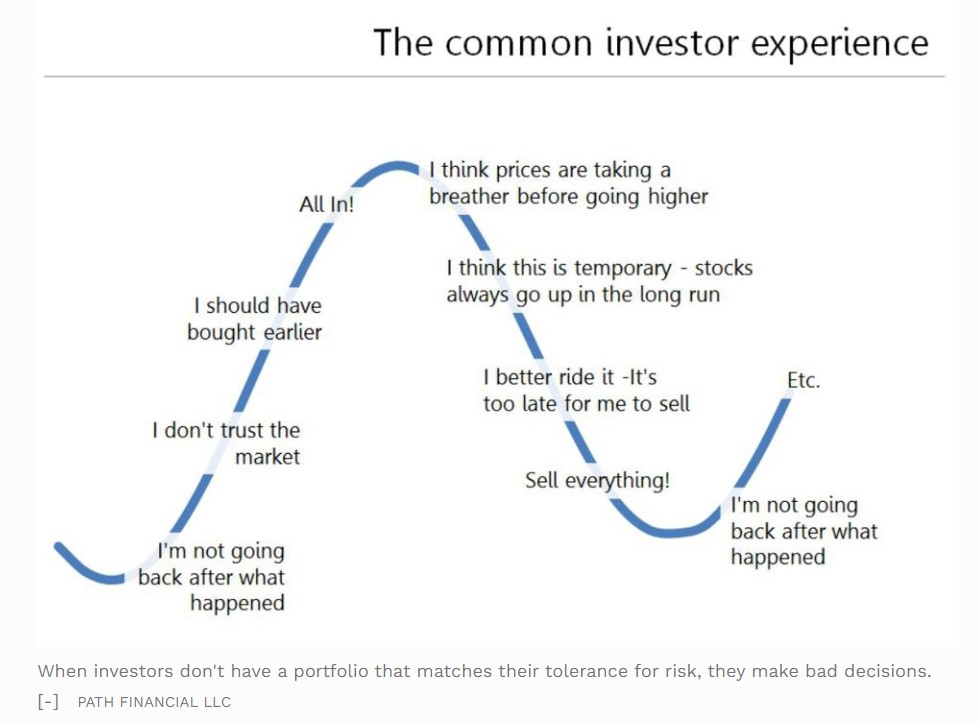

Here is an example of the typical investor experience during a market cycle. The average investor sells near the bottom of the bear market and goes all in at the top of the bull cycle.

Significant drops in stock value can trigger panic. However, fear-based selling to limit losses is the wrong move

Overall, markets are positive the majority of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Put another way; stocks have been on the rise 78% of the time.

If you are making sound investment choices, your patience and the ability to tolerate paper losses will earn you more in the long run.

2. Focus on your long-term goals

A market downturn can be tense for all investors. Regardless of how volatile the next bear market correction is, remember that “this too shall pass.”

Market crises come and go, but your goals will most likely remain the same. In fact, your goals have nothing to do with the market. Your investment portfolio is just one of the ways to achieve your goals.

Your personal financial goals can stretch over several years and decades. For investors in their 20s and 30s financial goals can go beyond 40 – 50 years. Even retirees in their 60s must ensure that their money and investments last through several decades.

Remain focused on your long-term goals. Pay off your debt. Stick to a budget. Maintain a high credit score. Live within your means and don’t risk more than you can afford to lose.

3. Don’t try to time the market

Many investors believe that they can consistently time the stock market to buy low and sell high. However, timing the market is a myth.

You need to be right twice

When you try to time the market, you have to make two crucial decisions – when to get in and when to get out. With a small margin of error, you must be consistently right all the time.

Missing the best days

Frequently the market selloffs precede broad market rallies. A V-shape recovery often follows a market correction.

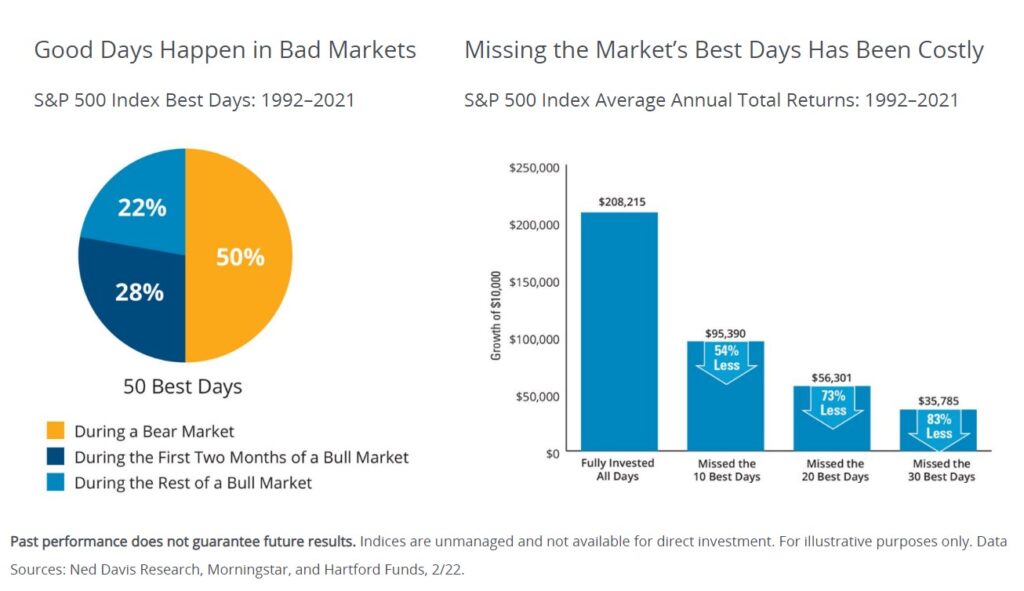

Half of the S&P 500 Index’s best days in the last 20 years occurred during a bear market. Another 28% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun. In other words, the best way to survive a bear market is to stay invested since it’s difficult to time the market’s recovery.

4. Diversify your portfolio

Diversification is essential for your portfolio preservation and growth. Diversification requires that you spread your investments among different asset classes such as domestic versus foreign stocks, large-cap versus small-cap equity, treasury and corporate bonds, real estate, commodities, precious metals, etc.).

Uncorrelated asset classes react uniquely during market downturns and changing economic cycles. For example, fixed income securities and gold tend to rise during bear markets when stocks fall and investors seek shelter. On the other hand, equities rise during economic expansion and a bull market,

Achieving divarication will lower the risk of your portfolio in the long run. It is the only free lunch you can get in investing.

5. Rebalance your portfolio regularly

Rebalancing your portfolio is a technique that allows your investment portfolio to stay aligned with your long terms goals while maintaining a desired level of risk. Typically, portfolio managers will sell out an asset class that has overperformed over the years and is now overweight. With the sale proceeds, they will buy an underweighted asset class.

Hypothetically, if you started investing in 2010 with a portfolio consisting of 60% Equities and 40% Fixed Income securities, without rebalancing by the end of 2021, you will hold 85% equities and 15% fixed income. Due to the last decade’s substantial rise in the stock market, many conservative and moderate investors may be holding significant equity positions in their portfolios. Rebalancing before a bear market downturn will help you bring your investments to your original target risk levels. If you reduce the size of your equity holdings, you will lower your exposure to stock market volatility.

6. Dollar-cost averaging

Picking the bottom during a bear market is impossible. If you are not willing to invest all your money at once, you can do it over a period of time. By using the dollar-cost averaging method, you invest your cash in smaller amounts at regular intervals, regardless of the movements in the market. When the stock market is down, you buy more shares. And it’s up you buy fewer shares.

If you regularly contribute to your 401k, you are effectively dollar-cost averaging.

Dollar-cost averaging takes the emotion out of investing. It prevents you from trying to time the market by requiring you to invest the same amount regardless of the market’s conditions.

7. Use tax-loss harvesting during bear markets

Tax-loss harvesting is a tax and investment technique that allows you to sell off stocks and other assets that have declined to offset current or future gains from other sources. You can then replace this asset with a similar but identical investment during a bear market to position yourself for future price recovery. Furthermore, you can use up to $3,000 of capital losses as a tax deduction from your ordinary income. Finally, you can carry forward any remaining losses for future tax years.

To take advantage of this option, you must follow the wash sale rule. You cannot purchase the same security in the next 30 days. To stay invested in the market, you can substitute the stock with another stock that has a similar profile or buy an ETF

The actual economic value of tax-loss harvesting lies in your ability to defer taxes into the future. You can think of tax-loss harvesting as an interest-free loan by the government, which you will pay off only after realizing capital gains. Therefore, the ability to generate long-term compounding returns on TLH strategy can appeal to disciplined long-term investors with low to moderate trading practices.

8. Roth Conversion

A bear market creates an excellent opportunity to do Roth Conversion. Roth conversion is transferring Tax-Deferred Retirement Funds from a Traditional IRA or 401k plan to a tax-exempt Roth IRA. The Roth conversion requires paying upfront taxes with the objective of decreasing your future tax burden.

The lower stock prices during a bear market will allow you to transfer a larger portion of your investments while paying lower taxes. For more about the benefits of Roth IRA read here. And for more information about Roth conversion, you can read our Roth conversion article.

9. Keep your emergency fund

I always recommend that my clients and blog readers keep at least six months of essential living expenses in a checking or a savings account. We call it an emergency fund. It’s rainy-day money, which you need to keep aside for crises and unexpected life events. Sometimes bear markets coincide with recessions and layoffs. If you lose your job, you will have enough reserves to cover your essential expenses and stay on your feet. Using your cash reserves will help you avoid dipping into your retirement savings.

10. Be opportunistic and invest

Bear markets create lifetime opportunities for buying stocks at discounted prices. One of the most famous quotes by Warren Buffet is, “When it’s raining gold, reach for a bucket, not a thimble.” Bear market selloffs rarely reflect the real long-term value of a company as they are triggered by panic, negative news, or geopolitical events. For long-term investors, bear markets present an excellent opportunity to buy their favorite stocks at a discounted price. If you want to get in the market after a selloff, look for established companies with strong secular revenue growth, experienced management, a strong balance sheet, and a proven track record of paying dividends or returning money to shareholders.

Final words

A bear market can take a massive toll on your emotions, investments, and retirement savings. The lack of reliable information and the instant spread of negative news can influence your judgment and force you to make rash decisions. Bear market selloffs can challenge even the most experienced investors. Don’t allow yourself to panic even if it seems like the world is falling apart. Prepare for the next market downturn by following my list of ten recommendations. This checklist will help you “survive” the next bear market while still following your long-term financial goals.

Contact Us