Tag Financial Planning

Your 401k contribution limits for 2026. Supercharge your wealth.

401(k) contribution limits for 2026 are $24,500 per person, up from $23,500 in 2025. All 401(k) participants aged 50 and over can make a standard catch-up contribution of $8,000, for a total of $32,500. Under the SECURE 2.0 Act, participants…

Know Your Tax Bracket in 2026

Tax Bracket in 2026. Understanding your 2026 tax brackets is crucial to managing your finances effectively. For the 2026 tax year, the IRS has adjusted income thresholds and standard deductions to account for inflation and new legislative updates under the…

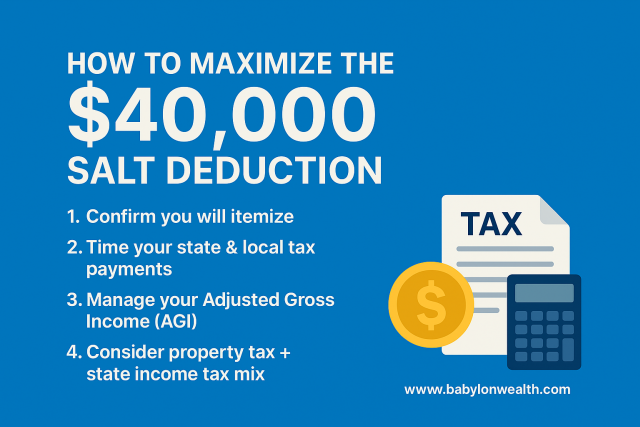

Maximize the $40,000 SALT Deduction: Strategies for High-Tax Households

For many taxpayers, the State and Local Tax (SALT) deduction is one of the most critical factors in determining their overall tax liability. With the cap on this deduction having been temporarily increased to $40,000 (up from the previous $10,000…

Powerful Tax Saving Moves for 2025

Tax Saving moves for 2025. As the 2025 tax season approaches, it’s the perfect time to take stock of your finances and find ways to reduce your tax bill. The Big Beautiful Bill introduced many changes to the taxation of…

The Big Beautiful Bill and What It Means for Your Wallet

The “Big Beautiful Bill” (BBB) represents one of the most sweeping federal tax reforms since the 2017 Tax Cuts and Jobs Act (TCJA). It includes income tax cuts, new savings vehicles, expanded deductions and credits, as well as targeted provisions…

How much do I need to save for retirement?

“How much to save for retirement?” Planning for retirement can be overwhelming. Many times, you may find yourself with more questions than answers. The magic number is a complex formula that depends on a combination of factors such as personal…

Your Roth Contribution Limits for 2025. Boost your tax free savings.

The Roth contribution limits for 2025 are $7,000 per person, with an additional $1,000 catch-up contribution for people who are 50 or older. There is no change from 2024. Roth IRA income limits for 2025 Roth IRA contribution limits for…

Know Your Tax Bracket in 2025

Understanding your tax brackets for 2025 is crucial in managing your finances effectively and ensuring you make the most of your income. Tax brackets determine the rate at which your income is taxed, and knowing where you fall can help…

Know your tax brackets for 2024

There are seven federal tax brackets for the 2024 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Every year, the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

Know your tax brackets for 2023

There are seven federal tax brackets for the 2023 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Every year the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

Tax brackets for 2022

There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Every year the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

Choosing between RSUs and stock options in your job offer

RSUs and stock options are the most popular equity compensation forms by both early-stage start-ups and established companies. If you receive equity compensation from your employer, there is a good chance that you own a combination of different equity grants.…

Achieving tax alpha and higher after tax returns on your investments

What is tax alpha? Tax Alpha is the ability to achieve an additional return on your investments by taking advantage of a wide range of tax strategies as part of your comprehensive wealth management and financial planning. As you know,…

5 reasons to leave your robo-advisor and work with a real person

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage…

Successful strategies for (NOT) timing the stock market

Timing the stock market is an enticing idea for many investors. However, even experienced investment professionals find it nearly impossible to predict the daily market swings, instant sector rotations, and ever-changing investors’ sentiments. The notion that you can perfectly sell…

Effective Roth Conversion Strategies for Tax-Free Growth

Roth conversion of your tax-deferred retirement savings can be a brilliant move. Learn the must-know rules and tax implications of Roth Conversion before you decide if it is right for you. What is a Roth Conversion? Roth Conversion is the…

Preparing for retirement during coronavirus

Are you preparing for retirement during the coronavirus crisis? Many professionals who are planning to retire in 2020 and beyond are facing unique challenges and circumstances. Probably your investment portfolio took a hit in February and March. Maybe your job…

15 Costly retirement mistakes

15 Costly retirement mistakes… Retirement is a major milestone for many Americans. Retiring marks the end of your working life and the beginning of a new chapter. As a financial advisor, I help my clients avoid mistakes and retire with…

How to Survive the next Market Downturn

Everything you need to know about surviving the next market downturn: we are in the longest bull market in US history. After more than a decade of record-high stock returns, many investors are wondering if there is another market downturn…

The biggest risks for your retirement savings

Whether you are just starting your career or about to retire, you need to understand the risks you are facing when you plan for your future retirement. Most experts recommend that you should aim to replace about 80% of work…

Contact Us