Tag Outlook

Guide to the coronavirus economic fallout

Our guide to the coronavirus economic fallout. The world is facing the biggest health crisis in 100 years. The COVID-19 outbreak has infected over 2 million people worldwide and caused hundreds of thousands of lost lives. The unprecedented global lockdown…

The Coronavirus and your money

The Coronavirus and your money. After an unprecedented 10% rally, which started in October of 2019, the stock market is finally hitting a rough patch. The quick spread of the coronavirus in China and around the world made investors nervous…

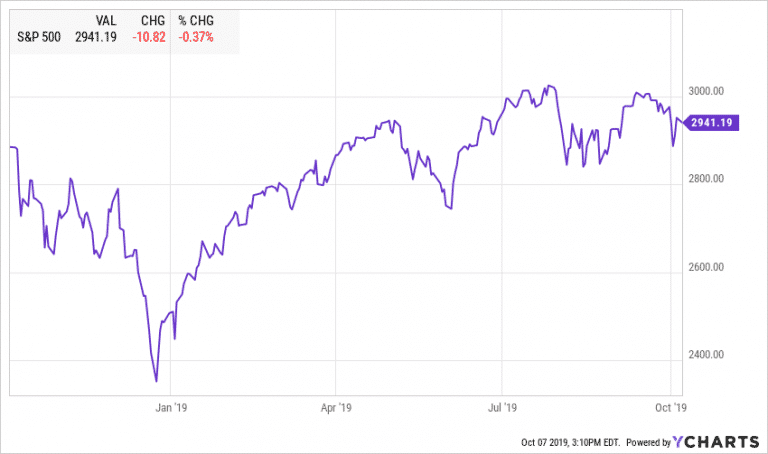

Market Outlook October 2019

Highlights: Economic Overview Equities US Equities had a volatile summer. Most indices are trading close to or below early July levels and only helped by dividends to reach a positive quarterly return. On July 27, 2019, S&P 500 closed at…

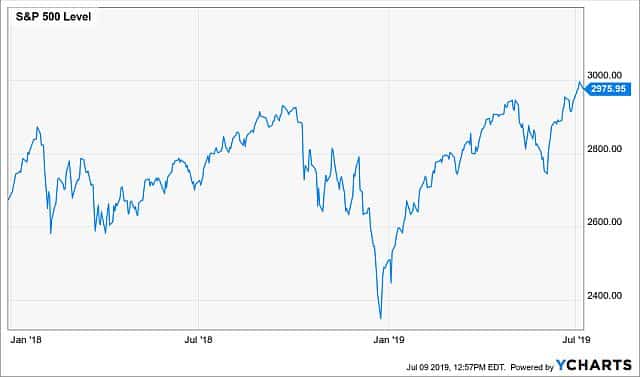

Market Outlook July 2019

Breaking records So far 2019 has been the year of breaking records. We are officially in the longest economic expansion, which started in June of 2009. After the steep market selloff in December, the major US indices have recovered their…

Contact Us