Guide to the coronavirus economic fallout

Our guide to the coronavirus economic fallout. The world is facing the biggest health crisis in 100 years. The COVID-19 outbreak has infected over 2 million people worldwide and caused hundreds of thousands of lost lives. The unprecedented global lockdown and social distancing policies became an existential threat to travel, entertainment, retail, and service businesses. Many companies from large to small struggle to cover their basic costs and pay employees. Despite the government’s initial hopes for a quick recovery and fast rebound, the economic conditions remain uncertain.

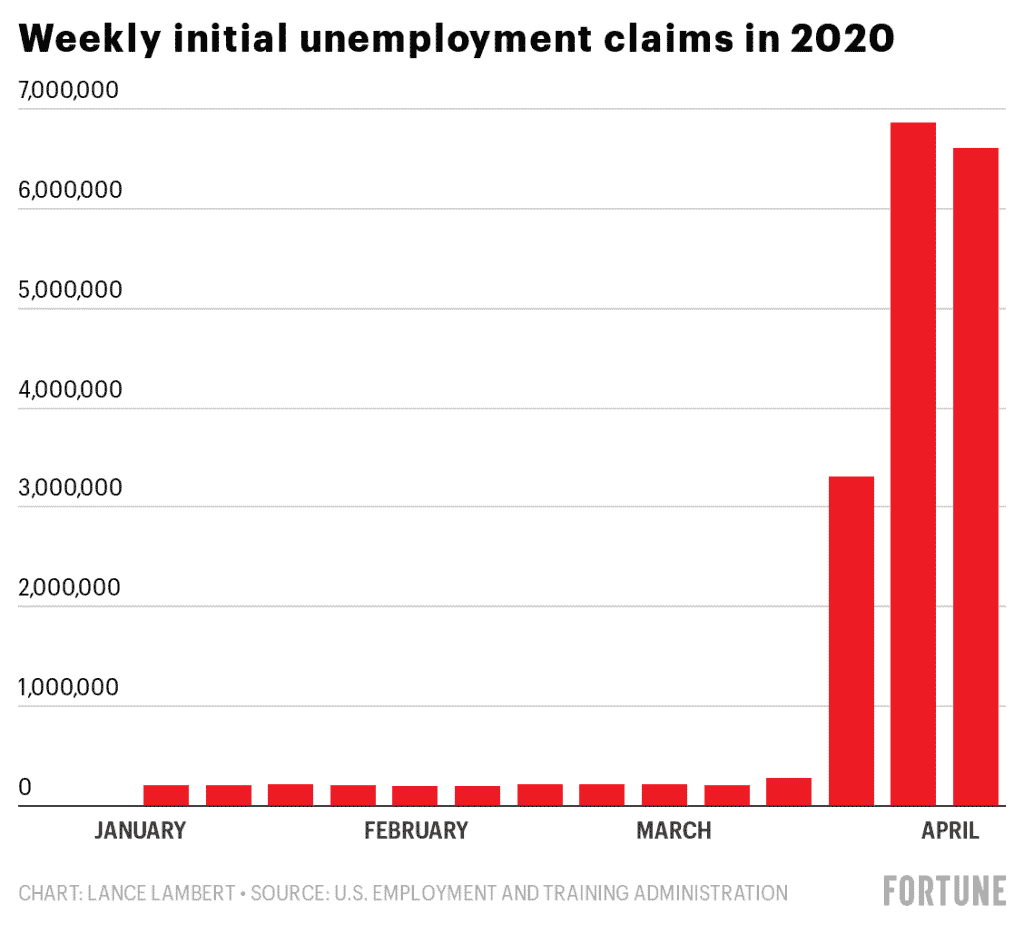

Unemployment

In a matter of a few weeks, 22 million Americans have filed for unemployment. Corporations, universities, local governments, and non-profit organizations of all sizes are furloughing workers. Disney has furloughed 70,000 cast members. Best Buy announced plans to furlough about 51,000 employees The New York Metropolitan Opera has furloughed all its union employees—musicians, chorus members, stagehands, and other supporting staff.

According to St. Louis Fed projections, the coronavirus economic freeze could cost 47 million jobs and send the unemployment rate past 32%. These figures are just staggering.

Fiscal Policy

In response to the coronavirus economic fallout, the Congress passed the Coronavirus Aid, Relief, and Economic Security Act of 2020. The CARES Act offered $2.2 trillion fiscal stimulus, intending to bring relief to families and businesses hit hardest by the impacts of the COVID-19 outbreak.

Support for Individuals and Families

- The CARES acts offered one-time stimulus checks of $1,200 for individuals with AGI up to $75,000 or a head of household with AGI up to. $112,500. All joint filers, with AGI up to $150,000 are eligible for $2,400. Those amounts increase by $500 for every child

- Eligible laid-off workers will get an extra $600 per week on top of their state benefit, until July 31.

- The federal government has waived up to six months of payments and interest for many federal student loan borrowers. Until Sept. 30, there will be automatic payment suspensions for any student loan held by the federal government

- Employers can pay up to $5,250 of student loans without that money counting as part of the employee’s income

- Waiving penalties for withdrawing of as much as $100,000 from IRA, 401k and other retirement plans

Support for Small Businesses

- The CARES Act provided $349 billion in partially forgivable SBA loans for small businesses with 500 or fewer employees to cover payroll and other expenses

- 50% refundable retention tax credit for employers to encourage businesses to keep workers on their payroll

- A delay in employer-side payroll taxes for Social Security until 2021 and 2022

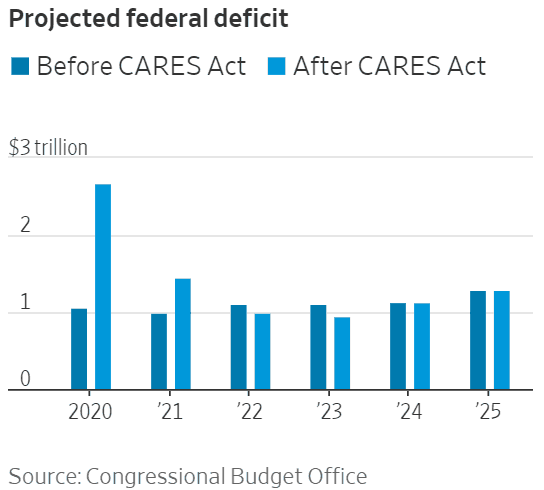

Growing budget deficit

According to the Congressional Budget, the stimulus package designed to mitigate the economic damage brought by the novel coronavirus pandemic will add $1.76 trillion to federal budget deficits over the coming decade. The CBO estimates that the Federal spending will rise by $1.314 trillion in the 2020 to 2030 period as a result of the legislation, At the same time revenues are expected to fall by $446 billion.

Monetary Policy

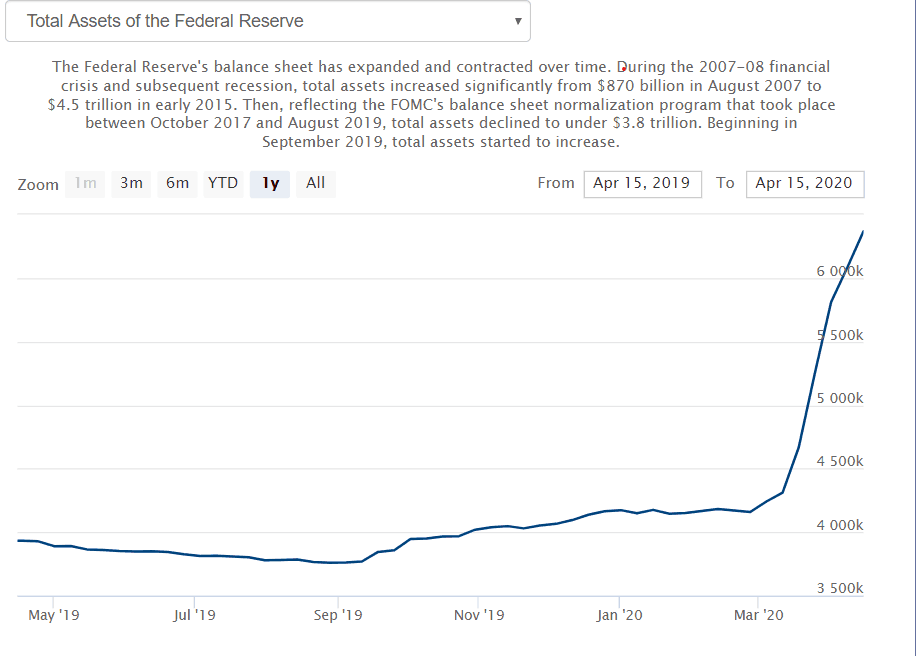

In response to the economic fallout, the Federal Reserve instituted a series of programs and measures to soften and battle the impact of the crisis. Among many things, the Fed dropped the Fed fund rate to zero. Furthermore, the Fed unleashed its crisis toolkit and restarted Quantitative Easing with the purchase of US treasuries and mortgage loans. The Fed has nearly unlimited power to buy repos, commercial papers, muni bonds, investment-grade bonds, bond ETFs and certain below-investment-grade bonds. The Fed also started a $600 billion lending facility to help businesses affected by the COVID-19 pandemic with up to 10,000 employees.

Unlike previous crises, the Fed acted proactively and rapidly in its efforts to dampen to negative effects of the sudden liquidity crisis. Its swift approach provided a financial lifeline to businesses and local governments. Despite the initial negative reactions, the Fed managed to reinstitute an order in the US bond market.

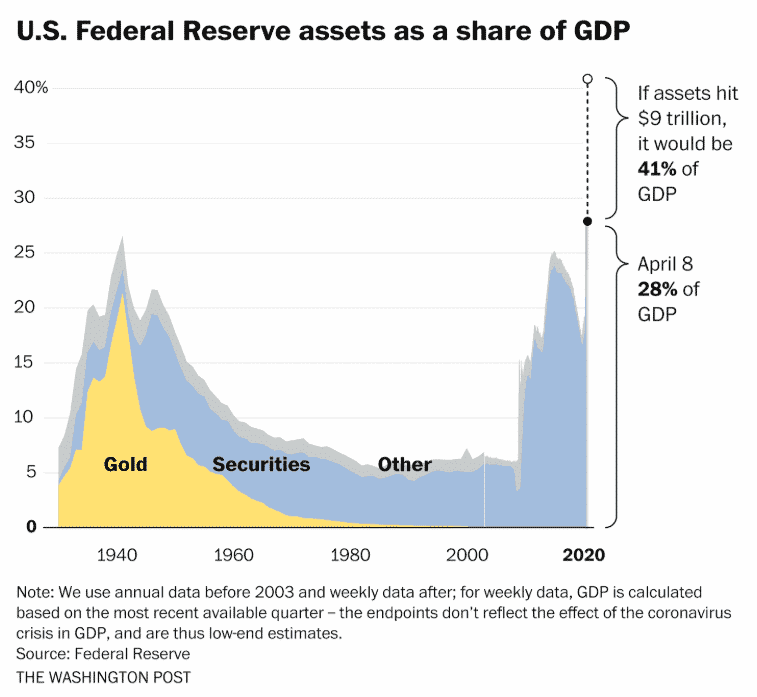

As a result of its efforts to combat the crisis, the Fed balance sheet has nearly doubled. The total share of Federal Reserve assets to GDP reached 28%. These levels were last seen since in the 1940s during the Gold standard.

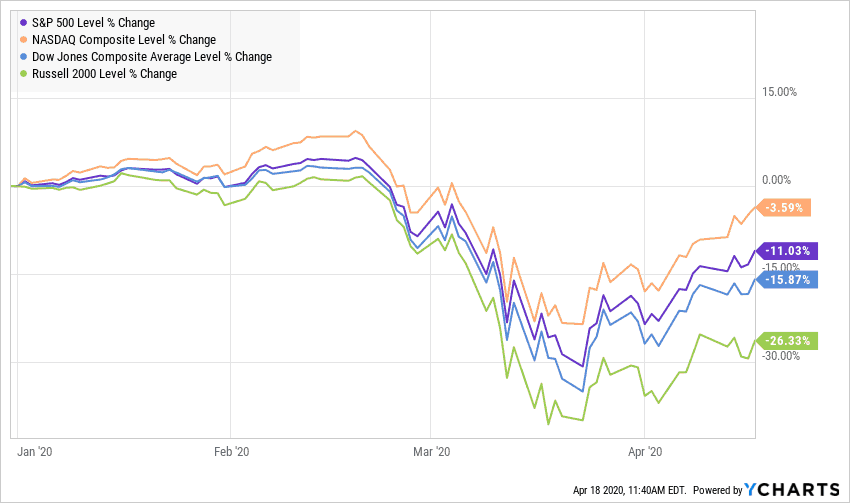

The stock market plunged and then bounced back

From February 20, 2020, to March 23, 2020, the S&P 500 lost nearly 34% of its value. Dow Jones Industrial fell -36%. The Nasdaq fared a little bit better at -29% loss. Russell 2000 dropped -40%.

Between March 23, 2020, till April 17, 2020, S&P 500 gained 28.5% with a total year to date loss of -11%. Nasdaq Composite was down -3% for 2020. Dow Jones Industrial Index lost -15%. While Russell 2000 was significantly lower at -26% for the year.

The most important driver for this rapid rebound was the Federal Reserve’s massive monetary stimulus plan, combined with the $2.2 trillion rescue package of the U.S. government. These unprecedented measures sent a confidence signal that the US is willing to take any step to save the economy.

Flight to quality and strong balance sheet

Amid initial fears and intense sell-off investors have moved to mega-cap companies with a strong balance sheet and core revenues that can weather the storm.

Some of the big winners of the coronavirus crisis are companies that directly benefit from a prolonged stay-at-home economy, a growing number of working from home business models, as well as pharma companies developing drugs and vaccines against the COVID-19 virus. The travel, retail, financial and energy companies were the hardest hit with many of them losing between 50% to 80% of their market value.

The Stock market and the Economy send conflicting messages

According to the Wall Street Journal – “The Dow Jones Industrial Average staged its best two-week performance since the 1930s, a dramatic rebound that has left many investors with a confounding reality: soaring share prices and a floundering economy.

The explosive rally is a sign that many are positioning for the U.S. to make a speedy recovery when the coronavirus crisis eases. Investors have been encouraged in recent days by signs that several states will move to resume business, along with hopes that a viable treatment for COVID-19 could be near.”

According to JP Morgan – “The Fed’s latest move reinforces our view of a full asset price recovery, and equity markets reaching all-time highs next year. Investors with [a] focus on negative upcoming earnings and economic developments are effectively ‘fighting the Fed,’ which was historically a losing proposition.”

Despite these positive views, this stock market rebound comes on the heels of growing unemployment, dropping retail sales, and Fed’s projections of US GDP falling by 5% in 2020.

We are in unchartered territory

- There is no playbook to combat this health crisis.

- The US economy was growing at a steady 2% a year with record-low unemployment. Restarting the economy at full speed may take several years

- China’s GDP shrank by 6.8% in the first quarter of 2020 giving us a glimpse of what to expect.

- Pre-crisis, many US workers had inadequate retirement savings and insufficient rainy-day money. There is many Americans living paycheck to paycheck.

- The small businesses which have always been the foundation of the US economy are facing an existential threat for survival. Many family-owned companies relying on higher volume sales and small margins may never be able to compete with large firms.

- The SBA $349 billion Paycheck Protection Program was depleted in less than 2 weeks.

- While many pharmaceutical companies are working on a COVID-19 vaccine, we do not expect the vaccine to be widely available until 2021. Some of the trial drugs that have shown positive treatment results will not be a solution for this crisis.

- We need rapid tests widely available to hospitals, businesses, airports, public venues, and schools. Some types of social distancing measures will continue through the end of 2020 and potentially 2021.

How to manage your investments and savings

We have very little control over the stock market and the economy. But we have full control of our actions.

During this crisis, focus on what you can control.

Set your financial goals and have a plan

Having a solid financial plan will help you ensure that you are following of your long-term financial goals and staying on track. The investment performance of your portfolio is a key component of your future financial success but it’s not the most important factor. Be disciplined, patient and consistent in following your long-term goals while putting emotions aside

If you do not have a financial plan, this a perfect time to start one. A holistic financial will help you create a comprehensive view of your personal and financial life and have a clear understanding of the main risks and abilities to achieve financial independence and confidence.

Keep cash

As a financial advisor, I always recommend keeping an emergency fund worth at least 6 to 12 months of your living expenses. An emergency fund will allow you to build a cushion and survive a prolonged economic uncertainty. Furthermore, it will prevent you from dipping into your retirement savings which could significantly deteriorate your financial health in the future. The best time to build your rainy-day fund is when the economy is strong and healthy.

Know your investment horizon

Your investment horizon is a product of your financial goals. It will determine the level of investment risk you should be taking. If you are retiring soon and need your investments for retirement income, then your investment horizon is short. Short investment horizon in general means a lower level of risk. If you are young and do not need your retirement savings and investments for a few years and decades, then your investment horizon is long. In this case, you can afford to take on more risk.

Assess your risk tolerance

Risk tolerance is a measure of our emotional ability to accept market volatility. It is not so simple to quantify people’s emotions with numbers. As humans, we are always more likely to be risk-averse during market turbulence and more risk-tolerant when the stock market is going higher. If you are willing to accept short-term losses for potential long-term gains, then your risk tolerance is high. If you are not willing to accept any losses, then your risk tolerance is very low.

Review your investment portfolio

Tune-up your investments regularly. You should review your investment portfolio in connection with your financial plan, investment horizon, and risk tolerance. Make sure that your investments support your financial goals and needs.

Keep your 401k

One of the biggest mistakes you could possibly make now is to drop and stop contributing to your 401k plan. Many people gave up on their retirement savings during the financial crisis and never restarted them. As a result, we have a generation of people with no retirement savings. As a 401k participant, you make regular monthly or semi-monthly payments to your plan. You benefit from dollar-cost averaging and buying stocks at lower prices during market volatility.

Take time to self-reflect and reconnect

Social distancing and stay-at-home lifestyle can emotionally burdensome and isolating. In these times, it is important to stay connected with friends and family. This is a great opportunity to learn new skills, reassess your priorities, and catch up on house projects. For those who like to travel, the economic slowdown is a paradise for travel deals.

Final words

If you have any questions about your investments and how to navigate through these turbulent times, feel free to reach out. if you are worried about finances I am here to listen and help.

Contact Us