Tag Personal Finance

10 Essential Money Saving Tips for 2024

10 Essential Money Saving Tips for 2024. It’s 2024. You turned a new chapter of your life. Here is an opportunity to make smart financial decisions and change your future. I have my list of ideas to help you care…

Know your tax brackets for 2024

There are seven federal tax brackets for the 2024 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Every year, the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

Where to invest your money in 2023?

Where to invest your money in 2023? The last few years have been a rollercoaster for stock and bond investors. First, we had to deal with covid lockdowns and supply chain disruptions. Then came the war in Ukraine and the…

Where is the stock market going in 2023?

The stock market posted impressive gains in the first two months of 2023. It’s fair to say that the strong market rally in January caught a lot of market experts and investors off guard. The general mood at the end…

10 Essential Money Saving Tips for 2023

10 Essential Money Saving Tips for 2023. It’s 2023. You turned a new chapter of your life. After experiencing once-in-a-lifetime events in 2022, here is an opportunity to make smart financial decisions and change your future. I have my list…

Know your tax brackets for 2023

There are seven federal tax brackets for the 2023 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Every year the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

Roth IRA and why you probably need one – Updated for 2022

Roth IRA is a tax-exempt investment account that allows you to make after-tax contributions to save for retirement. The Roth IRA has a tax-free status. It is a great way to save for retirement and meet your financial goals without…

Tax brackets for 2022

There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Every year the IRS modifies the tax brackets for inflation. Your specific bracket depends on your taxable income and filing status.…

5 reasons to leave your robo-advisor and work with a real person

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage…

New Year Financial Resolutions for 2022

New Year Financial Resolutions for 2022. It’s 2022. You turned a new chapter of your life. Here is an opportunity to make smart financial decisions and change your future. We have our list of ideas that can help you. Here…

Successful strategies for (NOT) timing the stock market

Timing the stock market is an enticing idea for many investors. However, even experienced investment professionals find it nearly impossible to predict the daily market swings, instant sector rotations, and ever-changing investors’ sentiments. The notion that you can perfectly sell…

New Year Financial Resolutions for 2021

New Year Financial Resolutions for 2021. Let’s kick off 2021 with a bang. It’s time to hit the refresh button. 2020 was very challenging. The covid pandemic brought enormous shifts to our daily lives. Social distancing. Working from home. Digital…

10 Behavioral biases that can ruin your investments

As a financial advisor, I often speak with my clients about behavioral biases. Our emotions can put a heavy load on our investment decisions. In this article, I would like to discuss ten behavioral biases that I encounter every day.…

The biggest risks for your retirement savings

Whether you are just starting your career or about to retire, you need to understand the risks you are facing when you plan for your future retirement. Most experts recommend that you should aim to replace about 80% of work…

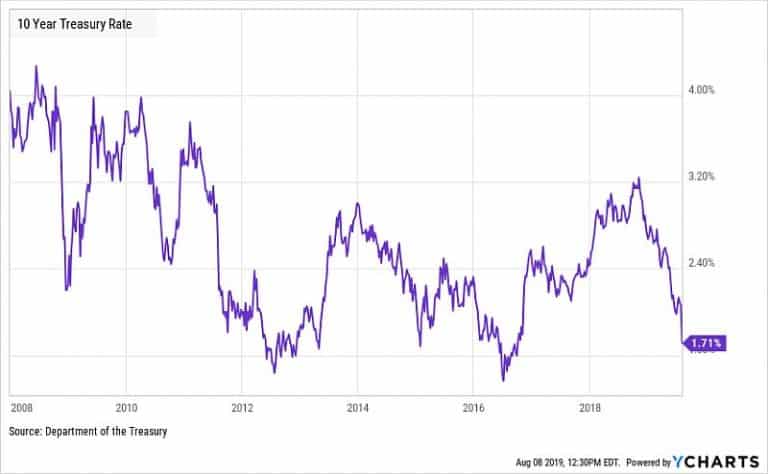

Why negative interest rates are bad for your portfolio

Quantitative Easing Ever since the financial crisis of 2008-2009, central banks around the world have been using lower interest rates and Quantitative Easing (QE) to combat to slow growth and recession fears. In the aftermath of the Great Recession, all…

The Secret to becoming a 401k millionaire

How to become a 401k millionaire? Today, 401k plans are one of the most popular employee benefits. Companies use 401k plans to attract top talent. 401k plan is a powerful vehicle to save for retirement and become financially independent. According…

The Smart Way to Manage Your Sudden Wealth

Getting rich is the dream of many people. When your sudden wealth becomes a reality, you need to be ready for the new responsibilities and challenges. As someone experienced in helping my clients manage their sudden wealth, I want to…

Essential Guide to Your Employee Stock Purchase Plan (ESPP)

What is an Employee Stock Purchase Plan (ESPP)? Employee Stock Purchase Plan (ESPP) is a popular tool for companies to allow their employees to participate in the company’s growth and success by becoming shareholders. ESPP will enable you to buy…

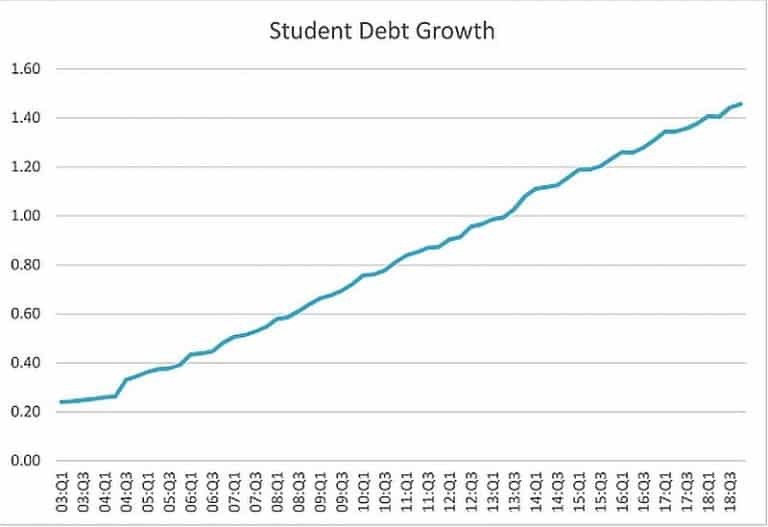

Solving the student debt crisis

The looming student debt crisis As a financial advisor working with many young families, I am regularly discussing college planning. Many of my clients want to help their children with the constantly growing college tuition. Currently, the amount of US…

All you need to know about Restricted Stock Units (RSUs)

Restricted Stock Units are a popular equity compensation for both start-up and public companies. Employers, especially many startups, use a variety of compensation options to attract and keep top-performing employees. Receiving RSUs allows employees to share in the ownership and…

Contact Us