Tag Student Debt

Saving for college with a 529 plan

What is a 529 plan? The 529 plan is a tax-advantaged state-sponsored investment plan that allows parents to save for their children’s college expenses. In the past twenty years, college expenses have skyrocketed exponentially, putting many families in difficult situation.…

Solving the student debt crisis

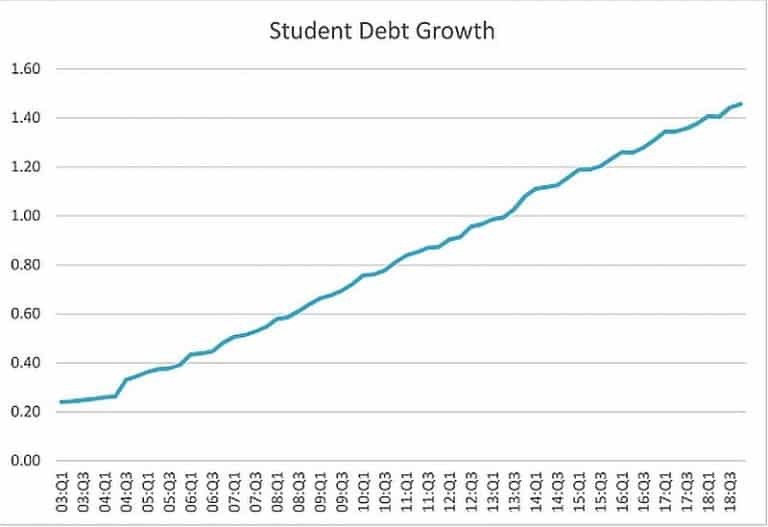

The looming student debt crisis As a financial advisor working with many young families, I am regularly discussing college planning. Many of my clients want to help their children with the constantly growing college tuition. Currently, the amount of US…

Contact Us