Tag Savings

10 Most Frequently Asked Questions About Retirement

Frequently Asked Questions About Retirement? Planning for retirement is one of the most important financial goals, yet many people have questions about how to prepare effectively. At Babylon Wealth Management, we help individuals navigate the complexities of retirement planning. Below…

10 Essential Money Saving Tips for 2024

10 Essential Money Saving Tips for 2024. It’s 2024. You turned a new chapter of your life. Here is an opportunity to make smart financial decisions and change your future. I have my list of ideas to help you care…

Roth IRA Contribution Limits 2024

The Roth IRA contribution limits for 2024 are $7,000 per person, with an additional $1,000 catch-up contribution for people who are 50 or older. There is a $500 increase from 2023. Roth IRA income limits for 2024 Roth IRA contribution…

10 Essential Money Saving Tips for 2023

10 Essential Money Saving Tips for 2023. It’s 2023. You turned a new chapter of your life. After experiencing once-in-a-lifetime events in 2022, here is an opportunity to make smart financial decisions and change your future. I have my list…

Charitable donations: 6 Tax Strategies – Updated for 2022

Charitable donations are an excellent way to help your favorite cause, church, foundation, school, or other registered charitable institution of your choice. Americans made $484.85 billion in charitable donations in 2021, which was 4% higher than 2020. The average annual…

Roth IRA Contribution Limits 2023

The Roth IRA contribution limits for 2023 are $6,500 per person with an additional $1,000 catch-up contribution for people who are 50 or older. There is $500 increase from 2022. Roth IRA income limits for 2023 Roth IRA contribution limits…

Roth IRA Contribution Limits 2022

The Roth IRA contribution limits for 2022 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. There is no change from 2021. Roth IRA income limits for 2022 Roth IRA contribution limits…

New Year Financial Resolutions for 2022

New Year Financial Resolutions for 2022. It’s 2022. You turned a new chapter of your life. Here is an opportunity to make smart financial decisions and change your future. We have our list of ideas that can help you. Here…

Roth IRA Contribution Limits 2021

The Roth IRA contribution limits for 2021 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Roth IRA income limits for 2021 Roth IRA contribution limits for 2021 are based on your…

IRA Contribution Limits 2022

The IRA contribution limits for 2022 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Contribution limits remain the same as 2021. What is an IRA? IRA or Traditional IRA is a…

IRA Contribution Limits 2021

The IRA contribution limits for 2021 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. What is an IRA? IRA or Traditional IRA is a tax-deferred retirement savings account that allows you…

New Year Financial Resolutions for 2021

New Year Financial Resolutions for 2021. Let’s kick off 2021 with a bang. It’s time to hit the refresh button. 2020 was very challenging. The covid pandemic brought enormous shifts to our daily lives. Social distancing. Working from home. Digital…

15 Costly retirement mistakes

15 Costly retirement mistakes… Retirement is a major milestone for many Americans. Retiring marks the end of your working life and the beginning of a new chapter. As a financial advisor, I help my clients avoid mistakes and retire with…

IRA Contribution Limits 2020

The IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. What is an IRA? IRA or Traditional IRA is a tax-deferred retirement savings account that allows you…

Roth IRA Contribution Limits 2020

The Roth IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Roth IRA income limits for 2020 Roth IRA contribution limits for 2020 are based on your…

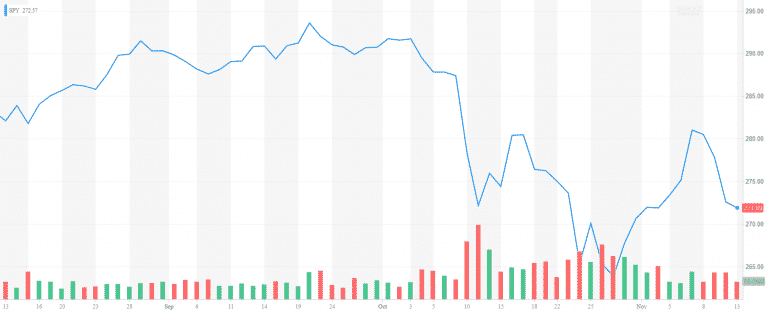

The recent market volatility – the tale of the perfect storm

The recent market volatility – the tale of the perfect storm October is traditionally a rough month for stocks. And October 2018 proved it. S&P 500 went down -6.9% in October after gaining as much as 10.37% in the first…

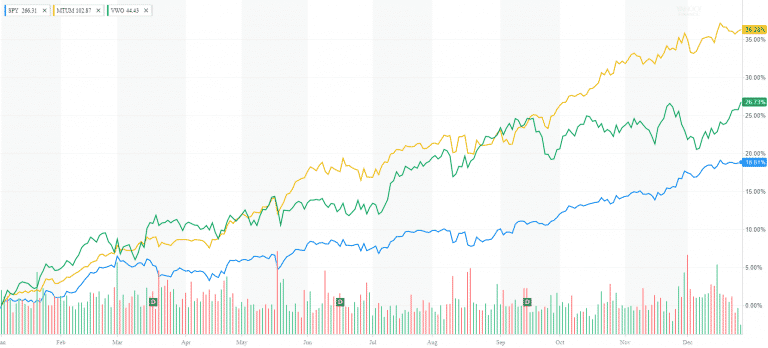

Market Outlook December 2017

Market Outlook December 2017 As we approach 2018, it‘s time to reconcile the past 365 days of 2017. We are sending off a very exciting and tempestuous year. The stock market is at an all-time high. Volatility is at a…

6 Saving & Investment Practices All Business Owners Should Follow

In my practice, I often meet with small business owners who have the entire life savings and family fortune tied up to their company. For many of them, their business is the only way out to retirement. With this post,…

10 ways to grow your savings during medical residency

As someone married to a physician, I happen to have many friends in the medical field. Most doctors have to go through a brutal residency program. The medical residency takes between three and five years. Residents have a hectic working…

Top 5 Strategies to Protect Your Portfolio from Inflation

Protecting Your Portfolio from Inflation The 2016 election revived the hopes of some market participants for higher interest rates and higher inflation. Indeed, the 10-year Treasury rate went from 1.45% in July to 2.5% in December before settling at around…

Contact Us