5 smart 401k moves to make in 2021

5 smart 401k moves to make in 2021 to boost your retirement saving. Do you have a 401k? These five 401k moves will help you grow your retirement savings and ensure that you take full advantage of your 401k benefits.

After a very challenging 2020, 2021 allows you to take another look at your 401k, reassess your financial priorities and .revaluate your retirement strategy, Let’s make sure that your 401k works for you.

Retirement CalculatorWhat is a 401k plan?

401k plan is a workplace retirement plan that allows employees to build and grow their retirement savings. It is one of the most convenient and effective ways to save for retirement as both employees and employers can make retirement contributions. You can set up automatic deductions to your 401k account directly through your company payroll as an employee. You can choose the exact percentage of your salary that will go towards your retirement savings. In 2021, most 401k will provide you with multiple investment options in stocks, fixed-income mutual funds, and ETFs. Furthermore, most employers offer a 401k match up to a certain percentage. In most cases, you need to participate in the plan to receive the match.

1. Maximize your 401k contributions in 2021

The smart way to boost your retirement savings is to maximize your 401k contributions each year.

Did you know that in 2021, you can contribute up to $19,500 to your 401k plan? If you are 50 or over, you are eligible for an additional catch-up contribution of $6,500 in 2021. Traditional 401k contributions are tax-deductible and will lower your overall tax bill in the current tax year.

Many employers offer a 401k match, which is free money for you. The only way to receive it is to participate in the plan. If you cannot max out your dollar contributions, try to deduct the highest possible percentage so that you can capture the entire match from your employer. For example, if your company offers a 4% match on every dollar, at the very minimum, you should contribute 4% to get the full match.

How to reach $1 million in your 401k by age 65?

Do you want to have $1 million in your 401k by the time you retire? The secret recipe is to start early. For example, if you are 25 old today, you only need to set aside $387 per month for 40 years, assuming a 7% annual return. If you are 35, the saving rate goes up to $820 per month. If you have a late start, you need to save about $3,000 a month in your 50s to get to a million dollars at the age of 65.

401k Contributions by Age

| Age | | | Monthly Contribution | Yearly Contribution | Lifetime Contribution | ||

| 25 | $387 | $4,644 | $190,404 | |||

| 30 | $560 | $6,720 | $241,920 | |||

| 35 | $820 | $9,840 | $305,040 | |||

| 40 | $1,220 | $14,640 | $380,640 | |||

| 45 | $1,860 | $22,320 | $468,720 | |||

| 50 | $3,000 | $36,000 | $576,000 | |||

| 55 | $5,300 | $63,600 | $699,600 |

2. Review your investment options

When was the last time you reviewed the investment options inside your 401k plan? When is the last time you made any changes to your fund selection? With automatic contributions and investing, it is easy to get things on autopilot. But remember, this is d your retirement savings. Now is the best time to get a grip on your 401k investments.

Look at your fund performance over the last 1, 3, 5, and 10 years and make sure the fund returns are close or higher than their benchmark. Review the fund fees. Check if there have been new funds added to the lineup recently.

What is a Target Date Fund?

A target-date fund is an age-based retirement fund that automatically adjusts your stock and bond investments allocation as you approach retirement. Young investors have a higher allocation to equities which are considered more risky assets. In comparison, investors approaching retirement receive a bigger share in safer investments such as bonds. By design, plan participants should choose one target-date fund, set it, and forget until they retire. The fund will automatically change the asset allocation as you near your retirement age.

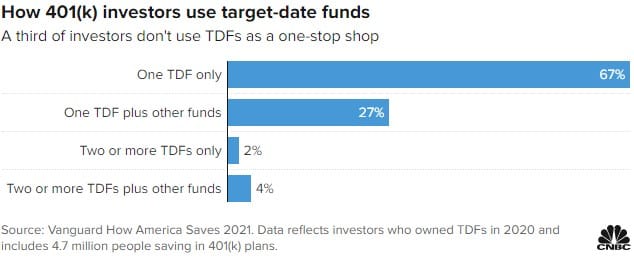

However, in a recent study, Vanguard concluded that nearly 33% percent of 401k plan participants misuse their target-date fund. A third of the people who own TDFs, combine them with another fund.

So if you own one or more target-date funds or combine them with other equity and bond funds, you need to take another look at your investment choices.

3. Change your asset allocation

Asset allocation tells you how your investments are spread between stocks, bonds, money markets, and other asset classes. Stocks typically are riskier but offer great earnings potential. Bonds are considered a safer investment but provide a limited annual return.

Your ideal asset allocation depends on your age, investment horizon, risk tolerance, and specific individual circumstances.

Typically, younger plan participants have a longer investment horizon and can withstand portfolio swings to achieve higher returns in the future. If you are one of these, investors can choose a higher allocation of stocks in your 401k.

However, if you are approaching retirement, you would have a much shorter investment horizon and probably lower tolerance to investment losses. In this case, you should consider adding more bonds and cash to your asset allocation.

4. Consider contributing to Roth 401k in 2021

Are you worried that you would pay higher taxes in the future? The Roth 401k allows you to make pretax contributions and avoid taxes on your future earnings. All Roth contributions are made after paying all federal and state income taxes now. The advantage is that all your prospective earnings will grow tax-free. If you keep your money until retirement or reaching the age of 59 ½, you will withdraw your gains tax-free. If you are a young professional or you believe that your tax rate will grow higher in the future, Roth 401k is an excellent alternative to your traditional tax-deferred 401k savings.

5. Rollover an old 401k plan

Do you have an old 401k plan stuck with your former employer? How often do you have a chance to review your balance? Unfortunately, many old 401k plans have become forgotten and ignored for many years.

It is a smart move to transfer an old 401k to a Rollover IRA.

The rollover is your chance to gain full control of your retirement savings. Furthermore, you will expand your investment options from the limited number of mutual funds to the entire universe of stocks, ETFs, and fund managers. Most importantly, you can manage your account according to your retirement goals.

Contact Us