12 End of Year Tax Saving Tips

As we approach the close of 2019, we share our list of 12 end of year tax saving tips. Now is a great time to review your finances. You can make several smart and simple tax moves that can help lower your tax bill and increase your tax refund.

The Tax Cuts and Jobs Act of 2017 made sweeping changes in the tax code that affected many families and small business owners. If the previous tax season caught you off-guard, now you have a chance to redeem yourself.

Whether you file taxes yourself or hire a CPA, it is always better to be proactive. If you are expecting a large tax bill or your financials have changed substantially since last year, talk to your CPA. Start the conversation. Don’t wait until the last moment. Being ahead of the curve will help you make well-informed decisions without the stress of tax deadlines.

1. Know your tax bracket

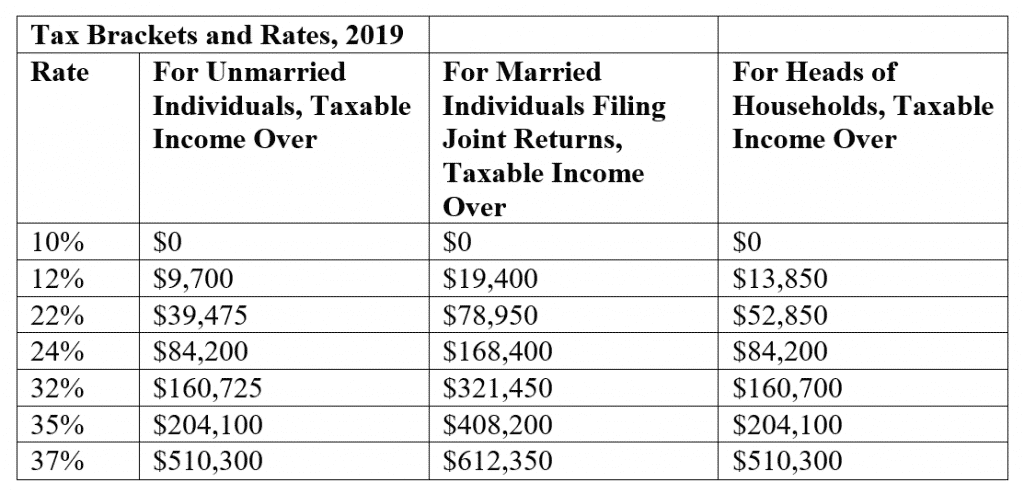

The first step of mastering your taxes is knowing your tax bracket. 2019 is the second year after the TCJA took effect. One of the most significant changes in the tax code was introducing new tax brackets.

Here are the tax bracket and rates for 2019.

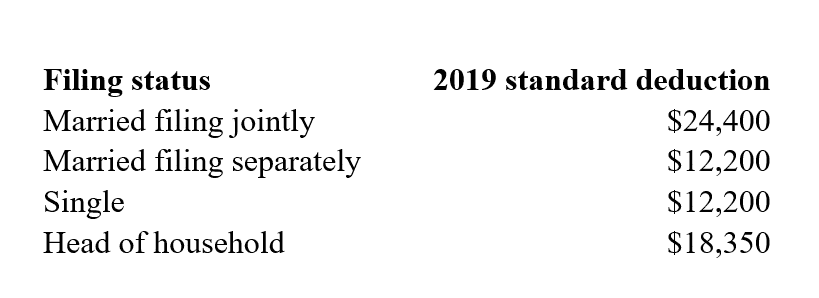

2. Decide to itemize or use a standard deduction

Another big change in the tax law was the increase in the standard deduction. The standard deduction is a specific dollar amount that allows you to reduce your taxable income. As a result of this change, nearly 90% of all tax filers will take the standard deduction instead of itemizing. It makes the process a lot simpler for many Americans. Here are the values for 2019:

3. Maximize your retirement contributions

Most contributions to qualified retirement plans are tax-deductible and will lower your tax bill.

- For employees – 401k, 403b, 457 and TSP. The maximum contribution to qualified employee retirement plans for 2019 is $19,000. If you are at the age of 50 or older, you can contribute an additional $6,000.

- For business owners – SEP IRA, Solo 401k and Defined Benefit Plan. Business owners can contribute to SEP IRA, Solo 401k, and Defined Benefits plans to maximize your retirement savings and lower your tax bill. The maximum contribution to SEP-IRA and Solo 401k in 2019 is $56,000 or $62,000 if you are 50 and older.

If you own SEP IRA, you can contribute up 25% of your business wages.

In a solo 401k plan, you can contribute as both an employee and an employer. The employee contribution is subject to a $19,000 limit plus a $6,000 catch-up. The employer match is limited to 25% of your compensation for the maximum $37,000. Depending on how you pay yourself, sometimes solo 401k can allow you for more savings than SEP IRA.

Defined Benefit Plans is an option for high-income earners who want to save more aggressively for retirement above the SEP-IRA and 401k limits. The DB plan uses actuary rules to calculate your annual contribution limits based on your age and compensation. All contributions to your defined benefit plan are tax-deductible, and the earnings grow tax-free.

4. Convert to Roth IRA

The process of transferring assets from a Traditional IRA or 401k plan to a Roth IRA is known as Roth Conversion. It allows you to switch from tax-deferred to tax-exempt retirement savings. You can learn more about the benefits of Roth IRA here.

The conversion amount is taxable for income purposes. The good news is that even though you will pay higher taxes in the current year, it may save you a lot more money in the long run.

While individual circumstances may vary, Roth Conversion could be very effective in a year with low or no income. Talk to your accountant or financial advisor. Ask if Roth conversion makes sense for you.

5. Contribute to a 529 plan

The 529 plan is a tax-advantaged state-sponsored investment plan, which allows parents to save for their children’s future college expenses. 529 plan works similarly to the Roth IRA. You make post-tax contributions. Your investment earnings grow free from federal and state income tax if you use them to pay for qualified educational expenses. Compared to a regular brokerage account, the 529 plan has a distinct tax advantage as you will never pay taxes on your dividends and capital gains.

Over 30 states offer a full or partial tax deduction or a credit on your 529 contributions. You can find the full list here. If you live in any of these states, your 529 contributions can lower your state tax bill significantly.

6. Make a donation

Donations to charities, churches, and various non-profit organizations are tax-deductible. You can support your favorite cause by giving back and lower your tax bill at the same time.

However, due to the changes in the new tax code, donations are tax-deductible only when you itemize your tax return. If you make small contributions throughout the year, you probably will be better off taking the standard deduction.

If itemizing your taxes is crucial for you, then you might want to consolidate your donations in one calendar year. So, instead of making multiple charitable contributions over the years, you can give one large donation every few years.

7. Sell losing investments

The process of selling losing investments to reduce your tax liability is known as tax-loss harvesting. It works for capital assets held outside retirement accounts (such as 401k, Traditional IRA, and Roth IRA). Capital assets may include real estate, cars, gold, stocks, bonds, and any investment property, not for personal use.

The IRS allows you to use capital losses to offset capital gains. If your capital losses are higher than your capital gains, you can deduct the difference as a loss on your tax return. This loss is limited to $3,000 per year or $1,500 if married and filing a separate return.

8. Prioritize long-term over short-term capital gains

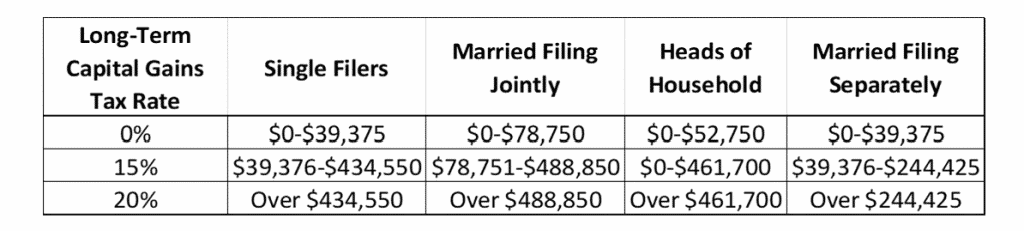

Another way to lower your tax bill when selling assets is to prioritize long-term over short-term capital gains. The current tax code benefits investors who keep their assets for more than one calendar year. Long-term investors receive a preferential tax rate on their gains. While investors with short-term capital gains will pay taxes at their ordinary income tax level

Here are the long-term capital gain tax brackets for 2019:

High-income earners will also pay an additional 3.8% net investment income tax.

9. Take advantage of FSA and HSA

With healthcare costs always on the rise, you can use a Flexible Spending Account (FSA) or a Health Savings Account (HSA) to cover your medical bills and lower your tax bill.

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) is a tax-advantaged savings account offered through your employer. The FSA allows you to save pre-tax dollars to cover medical and dental expenses for yourself and your dependents. The maximum contribution for 2019 is $2,700 per person. If you are married, your spouse can save another $2,700 for a total of $5,400 per family. Typically, you should use your FSA savings by the end of the calendar year. However, the IRS allows you to carry over up to $500 balance into the new year.

Dependent Care FSA (CSFSA)

A Dependent Care FSA (CSFSA) is a pre-tax benefit account that you can use to pay for eligible dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult daycare. It’s an easy way to reduce your tax bill while taking care of your children and loved ones while you continue to work. The maximum contribution limit for 2019 for an individual who is married but filing separately is $2,500. For married couples filing jointly or single parents filing as head of household, the limit is $5,000.

Health Savings Account (HSA)

A Health Savings Account (HSA) is an investment account for individuals under a High Deductible Health Plan (HDHP) that allows you to save money on a pre-tax basis to pay for eligible medical expenses.The qualified High Deductible Plan typically covers only preventive services before the deductible. To qualify for the HSA, the HDHP should have a minimum deductible of $1,350 for an individual and $2,700 for a family. Additionally, your HDHP must have an out-of-pocket maximum of up to $6,750 for one-person coverage or $13,500 for family.

The maximum contributions in HSA for 2019, are $3,500 for self-only coverage and $7,000 for a family. HSA participants who are 55 or older can contribute an additional $1,000 as a catch-up contribution. Unlike the FSA, the HSA doesn’t have a spending limit, and you can carry over the savings in the next calendar year.

Keep in mind that the HSA has three distinct tax advantages. First, all HSA contributions are tax-deductible and will lower your tax bill. Second, you will not pay taxes on dividends, interest, and capital gains. Third, if you use the account for eligible expenses, you don’t pay taxes on those withdrawals either.

10. Defer income

Deferring income from this calendar year into the next year will allow you to delay some of the income taxes coming with it. Even though it’s not always possible to defer wages, you might be able to postpone a large bonus, royalty, or onetime payment. Remember, it only makes sense to defer income if you expect to be in a lower tax bracket next year.

Reversely, if you are expecting to be in a higher tax bracket tax year next year, you may consider taking as much income as possible in this tax year.

11. Buy Municipal Bonds

Municipal bonds are issued by local governments, school districts, and authorities to fund local projects that will benefit the general public. The interest income from most municipal bonds is tax-free. Investors in these bonds are exempt from federal income tax. If you buy municipal bonds issued in the same state where you live, you will be exempt from state taxes as well.

12. Take advantage of the 199A Deduction for Business Owners

If you are a business owner or have a side business, you might be able to use the 20% deduction on qualified business income. The TCJA established a new tax deduction for small business owners of pass-through entities like LLCs, Partnerships, S-Corps, and sole-proprietors. While the spirit of the law is to support small business owners, the rules of using this deduction are quite complicated and restrictive. For more information, you can check the IRS page. In summary, qualified business income must be related to conducting business or trade within the United States or Puerto Rico. The tax code also separates the business entities by industry – Qualified trades or businesses and Specified service trades or businesses.

Qualified versus specified service trade

Specified service businesses include the following trades: Health (e.g., physicians, nurses, dentists, and other similar healthcare professionals), Law, Accounting, Actuarial science, Performing arts, Consulting, Athletics, and Financial Services. Qualified trades or businesses is everything else.

For “specified service business,” the deduction gets phased out between $315,000 and $415,000 for joint filers. For single filers, the phase-out range is $157,500 to $207,500.

The qualified trades and businesses are also subject to the same phaseout limits. However, if their income is above the threshold, the 199A deduction becomes the lesser of the 20% of qualified business income deduction or the greater of either 50 percent of the W-2 wages of the business, or the sum of 25% of the W-2 wages of the business and 2.5% of the unadjusted basis immediately after acquisition of all qualified property.

If this all sounds very complicated to you, it’s because it is complicated.Contact your accountant or tax adviser to see if you can take advantage of this deduction.

Contact Us