Five Investment Ideas for 2021

Investment ideas for 2021. 2020 was a challenging and transformative year. The world was battling with a new virus that spread nondiscriminatory around the globe. Entire countries shut down to protect themselves from the hidden enemy. As it happens always in human history, crisis creates opportunities. Established businesses had to adapt to the new regime and emerging companies offered innovative solutions.

In my article “Investment ideas for 2020“, I set my expectations for double-digit growth in e-commerce, cloud computing, cybersecurity, logistics, work from home, digital payments, 5G, and socially responsible investing. These sectors played a central role in our fight with covid 19 and will impact the economy in the foreseeable future. You can read the full article here.

Today I am offering you the second article in this investment ideas series. We will focus on areas that will benefit from the reopening of the world economies. With the covid vaccine reaching more people in more countries, we will observe a coordinated global recovery. The unprecedented global financial stimulus and near “boiling” penned-up demand will drive higher economic activity and consumer spending,

1. Utilities

Utilities are my top investment ideas for 2021. Utility stocks received very little love from the investment community in 2020. They came out of favor despite being one of the best performing sectors the previous decade. Investors worried about reduced business activity and deteriorating consumer health caused by the covid pandemic. Many of these fears turned out to be immaterial. And most utilities posted stable revenue and earnings in 2020. What happened? More people worked from home, which caused high home utility bills. Low-income families received various stimulus payments and forbearance options, which allowed them to pay their bills. Even after the sharp drop in March, the US manufacturing and non-manufacturing activity rebounded quickly to pre covid levels.

In spite of their slow growth, historically, utilities have followed the broader stock market very closely. Furthermore, most established utility companies pay a stable dividend in the range of 3% to 4%. They are an attractive option for income-seeking investors. Some experts consider utilities as bond proxies. They tend to have a lower correlation with the rest of the stock market.

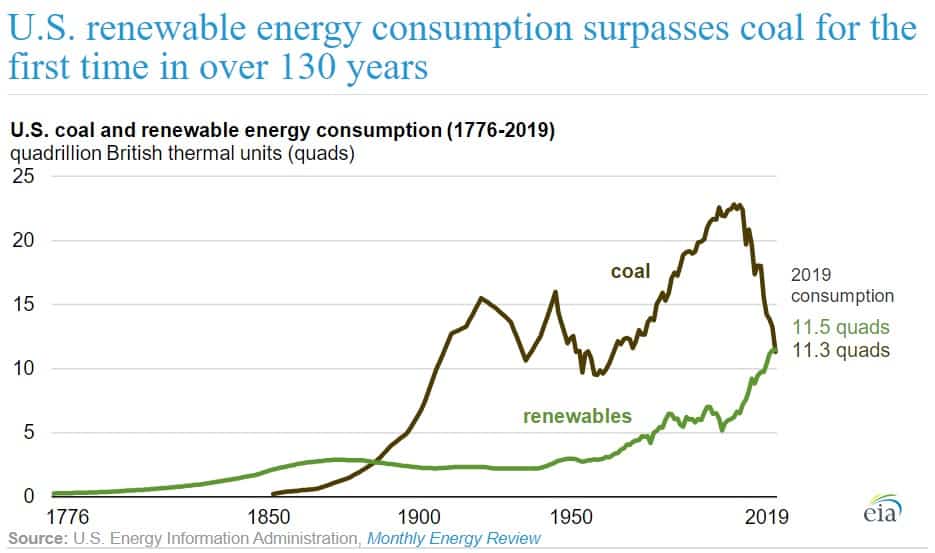

US renewable energy consumption is growing

Where we stand today, many utilities are in the front and center of our fight against climate change and global warming. Many utilities aggressively move towards renewable energy sources such as solar panels, hydroelectric dams, wind turbines, geothermal and biomass energy. Renewable energy collectively provided more power than coal plants for the first time in 2019.

Utilities remain deeply dependent on natural gas and fossil fuel. However, I believe that further innovation in battery storage and capacity utilization will continue to boost renewable energy growth. Furthermore, for the firm believers in electric vehicles and clean energy, the boring old-fashioned utilities will become quintessential in moving the needle towards widespread adoption.

2. Healthcare and Life Science

2020 was both ruthless and transformational for the healthcare industry. Healthcare workers around the world have been and remain in the frontline battle against Covid-19. We all have seen images of doctors and nurses sharing pictures after an exhausting shift in their covid unit. I know healthcare workers (including my dad) who lead the fight every day. As someone married to a physician, I have a close-up experience with the challenges and transformations that occurred in the past 12 months.

New chapter for healthcare

Telehealth will become the norm in general medicine. As more professionals and patients become comfortable with the use of technology, telemedicine will offer access to more affordable and better-quality care for many people worldwide. For healthcare systems, it is a chance to cut costs, improve burnout rates amongst doctors and hire top talent without the need to relocate.

Medical Devices. 2021 and 2022 can see a surge for elective and nonessential medical procedures. The global pandemic forced many people and hospitals to delay non-life-threatening, elective, and cosmetic surgeries and procedures. I believe that as we get a tighter grip on the virus through vaccination and rollout of new viral drugs, we can see a slow and steady growth on this side of healthcare.

New Treatments. The pharmaceutical and biotech industry is in the early innings of developing a new generation of patient treatment. From gene sequencing and immunotherapies to multi-cancer screening offer a unique opportunity in the battle against cancer and other rare diseases.

3. Financials

I started writing this article in the first weeks of 2021 before the rally in banks, which was caused by the rise in US treasury yields. As a result, most banks are now trading near or above pre-covid levels. Nevertheless, financials are one of our investment ideas for 2021.

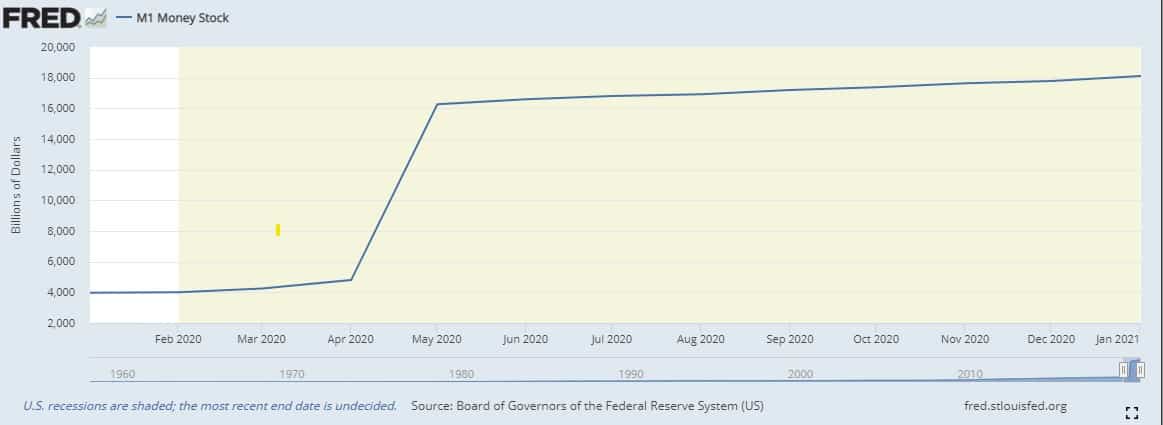

Despite initial concerns over liquidity and credit losses, banks maintained a strong balance sheet and reported revenue and earnings well above analyst estimates. The unprecedented stimulus has flooded the financial system with cash. The US economy’s cash supply went from $3.9T pre covid to $18.1T as of January 31, 2021. A large portion of the cash is sitting with banks waiting to be deployed.

US M1 Supply

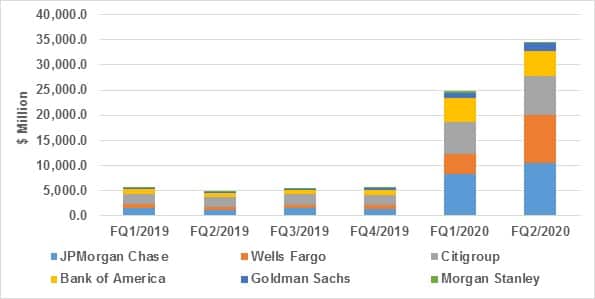

Furthermore, most banks took significant loan loss provision reserves. For example, Bank of America alone took $11.3 billion in reserves in 2020 versus $3.6 billion in 2019. I expect that the banks will release most of these provisions, which they can use to pay higher dividends, share buybacks, and improve operational efficiencies.

U.S. Bank Stocks – Provisions for Loan Losses (2019-2020)

Before you get too excited about investing in banks, remember that the entire financial industry is undergoing a massive digital transformation. The old brick and mortar branches are slowly losing their footprint. PayPal and Square are taking market shares in the growing digital payment space. For example, PayPal reported 20% higher revenue in 2020, Square doubled it. While Bank of America dropped revenue by -5%. Therefore, expect the bank of the future to be leaner, less physical, more personalized, more digital, and more focused on user experience.

4. Discretionary spending

Millions of individuals and families have cooped-up in our homes for more than a year. As many of us were unable to travel and spend time with our friends and family, we will observe a significant increase in discretionary spending as the covid vaccine distribution reaches more people worldwide. Furthermore, the $1.9 trillion Covid relief bill will put cash in the hands of many struggling US families. The latest round of stimulus promises $1,400 payments and child credits.

Bloomberg Economics estimates that Americans have accumulated $1.7 trillion in excess savings since the beginning of the pandemic through January 2021.

With the world economies reopening, discretionary spending will continue to rise. Therefore, I expect consumers to spend more discretionary income on travel, leisure, wellbeing, luxury goods, 5G phones and gadgets, and home improvement. For one, I cannot wait to be able to travel again.

5. Technology

Technology remains firmly one of our top investment ideas for 2021. Tech stocks will continue to dominate the stock markets and the US economy. The covid pandemic boosted the role of technology in our daily lives. Tech giants were in a unique position in 2020. Their strong balance sheet and ability to adapt quickly accelerated their customers’ awareness and adoption. From ordering food and groceries online, applying for a mortgage loan online to digital signature, voice control, video calls, and 5G, technology is everywhere.

The covid outbreak pushed every single business sector towards digital transformation. As a result, more private businesses and government organizations are embracing data analytics, cloud computing, cybersecurity, customer service, experience management to improve their service, understand their customers and strengthen their data. Gartner projects that spending on public cloud services will grow by 18.4% in 2021 to total $304.9 billion, up from $257.5 billion in 2020. Furthermore, the expansion of 5G networks will set the stage for significant innovations in autonomous driving, connected devices, smart homes, artificial intelligence, and virtual / augmented reality.

Contact Us