Category Retirement Planning

Understanding Tail Risk and how to protect your investments

What is Tail Risk? Tail Risk is the possibility of suffering large investment losses due to sudden and unforeseen events. The name tail risk comes from the shape of the bell curve. Under normal circumstances, your most likely investment returns…

10 practical ways to pay off debt before retirement

Pay off debt before retirement is a top priority for many of you who are planning to retire in the near future. In my article Retirement Checklist, I discussed a 12-step roadmap to planning a successful and carefree retirement. One…

Benefits and drawbacks to buying Indexed Universal Life Insurance

Today, I am going off the beaten path for me and will discuss the pros and cons of buying Indexed Universal Life Insurance. As a fee-only advisor, I do not sell any insurance or commission-based products. However, on numerous occasions,…

401k contribution limits 2021

401k contribution limits for 2021 are $19,500 per person. All 401k participants over the age of 50 can add a catch-up contribution of $6,500. What is 401k? 401k plan is a workplace retirement plan where both employees and employers can…

Roth IRA Contribution Limits 2021

The Roth IRA contribution limits for 2021 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Roth IRA income limits for 2021 Roth IRA contribution limits for 2021 are based on your…

IRA Contribution Limits 2022

The IRA contribution limits for 2022 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Contribution limits remain the same as 2021. What is an IRA? IRA or Traditional IRA is a…

IRA Contribution Limits 2021

The IRA contribution limits for 2021 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. What is an IRA? IRA or Traditional IRA is a tax-deferred retirement savings account that allows you…

TSP contribution limits 2022

TSP contribution limit for 2022 is 20,500 per person. Additionally, all federal employees over the age of 50 can contribute a catch-up of $6,500 per year. What is TSP? Thrift Saving Plan is a Federal retirement plan where both federal…

TSP contribution limits 2021

TSP contribution limits for 2021 is 19,500 per person. Additionally, all federal employees over the age of 50 can contribute a catch-up of $6,500 per year. What is TSP? Thrift Saving Plan is a Federal retirement plan where both federal…

5 smart 401k moves to make in 2020

5 smart 401k moves to make in 2020. Do you have a 401k? These five 401k moves will help you empower your retirement savings and ensure that you take full advantage of your 401k benefits. 2020 has been a challenging…

Grow your retirement savings with the Thrift Savings Plan

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees. The purpose of the TSP is to provide federal workers with a platform for long-term retirement savings where you can make regular monthly payroll contributions. In many…

15 Costly retirement mistakes

15 Costly retirement mistakes… Retirement is a major milestone for many Americans. Retiring marks the end of your working life and the beginning of a new chapter. As a financial advisor, I help my clients avoid mistakes and retire with…

TSP contribution limits 2020

TSP contribution limits for 2020 is 19,500 per person. Additionally, all federal employees over the age of 50 can contribute a catch-up of $6,500 per year. What is TSP? Thrift Saving Plan is a Federal retirement plan where both federal…

IRA Contribution Limits 2020

The IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. What is an IRA? IRA or Traditional IRA is a tax-deferred retirement savings account that allows you…

Roth IRA Contribution Limits 2020

The Roth IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Roth IRA income limits for 2020 Roth IRA contribution limits for 2020 are based on your…

401k contribution limits 2020

401k contribution limits for 2020 are $19,500 per person. All 401k participants over the age of 50 can add a catch-up contribution of $6,500. What is 401k? 401k plan is a workplace retirement plan where both employees and employers can…

Preparing for retirement during coronavirus

Are you preparing for retirement during the coronavirus crisis? Many professionals who are planning to retire in 2020 and beyond are facing unique challenges and circumstances. Probably your investment portfolio took a hit in February and March. Maybe your job…

Guide to the coronavirus economic fallout

Our guide to the coronavirus economic fallout. The world is facing the biggest health crisis in 100 years. The COVID-19 outbreak has infected over 2 million people worldwide and caused hundreds of thousands of lost lives. The unprecedented global lockdown…

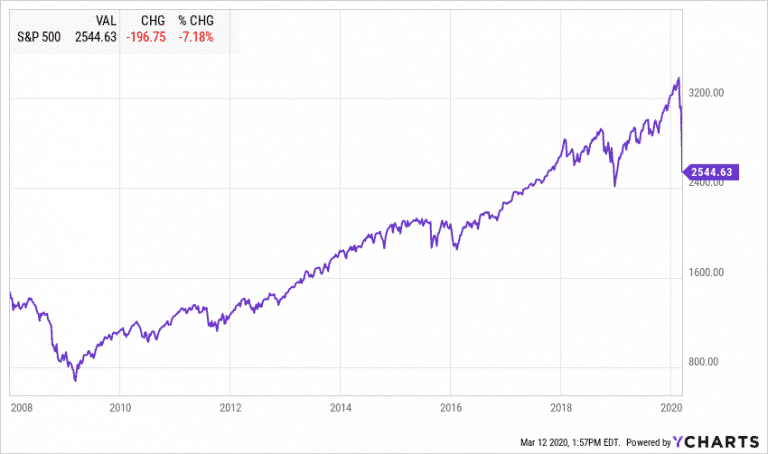

Navigating the market turmoil after the Coronavirus outbreak

Here is how to navigate the market turmoil after the Coronavirus outbreak, the stock market crash, and bottom low bond yields. The longest bull market in history is officially over. Today the Dow Jones recorded its biggest daily loss since…

Early retirement for physicians

Early retirement for physicians….As someone married to a physician and surrounded by many friends in the medical field, I know that early retirement is on the minds of many physicians. If you are reading this article, you have probably put…

Contact Us