Grow your retirement savings with the Thrift Savings Plan

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees. The purpose of the TSP is to provide federal workers with a platform for long-term retirement savings where you can make regular monthly payroll contributions. In many ways, TSP resembles the 401k plans used by private corporations.

Retirement CalculatorTSP Eligibility

Most employees of the United States Government are eligible to participate in the Thrift Savings Plan. You qualify if you are:

- Federal Employees’ Retirement System (FERS) employees (started on or after January 1, 1984)

- Civil Service Retirement System (CSRS) employees (began before January 1, 1984, and did not convert to FERS)

- Members of the uniformed services (active duty or Ready Reserve)

- Civilians in specific other categories of Government service including some congressional positions and judges

Contribution Limits for 2020

Federal employees can contribute up to $19,500 in their Thrift Savings Plan in 2020. Additionally, all federal employees over the age of 50 can make a catch-up contribution of $6,500 per year.

Members of the uniformed services, receiving tax-exempt pay that is subject to the combat zone tax exclusion, can make contributions up to the combined limit of $57,000 per year.

TSP Matching

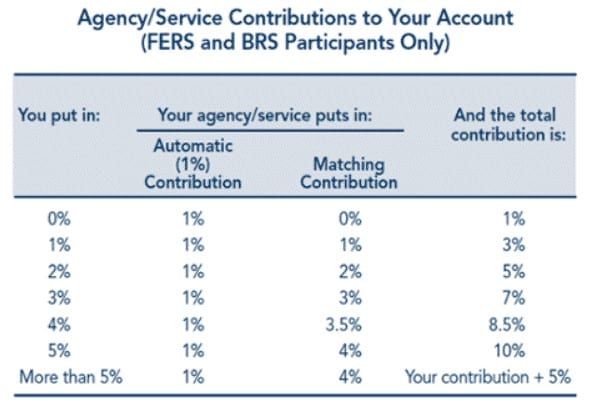

TSP participants receive matching contributions on the first 5% of your salary that you contribute each pay period. The first 3% of your contribution will get a dollar-for-dollar match. The next 2% will be matched at 50 cents on the dollar. Contributions above 5% of your salary do not receive an additional match.

Federal agencies can make a matching contribution up to the combined limit of $57,000 or $63,500 with the catch-up contribution. If you contribute the maximum allowed amount, your agency match cannot exceed $37,500 in 2020. Receiving a match on your contributions is free money. You must contribute at least 5% of your base salary to your TSP account to get the full match from your agency.

Matching schedule

The table below illustrates how your agency makes a matching contribution to your TSP account based on your own selection. Even if you choose not to contribute to TSP, you will still receive 1% of your base pay. If you put aside 5% of base pay, you will get the full 5% match from your agency.

Source: opm.gov

TSP Vesting

For vesting purposes, there are two types of agency contributions.

Agency Automatic Contributions (1%)

All eligible TSP participants will automatically receive deposits into your account equal to 1% of your basic pay each pay period, even if you do not contribute your own money. After three years of Federal civilian service (or two years in some cases), you are vested in these contributions and their earnings.

Agency Matching Contributions (0% – 4%)

All eligible federal employees will receive a dollar for dollar matching contribution for the first 3% that you contribute each pay period. Each dollar of the next 2% of basic pay will be matched with 50 cents on the dollar. All matching contributions are vested immediately.

How to grow your retirement savings with TSP

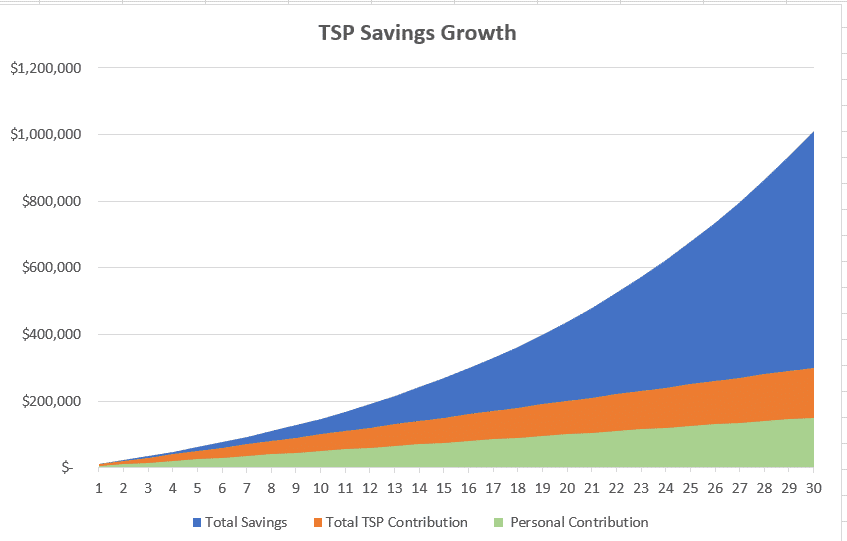

The Thrift Savings Plan allows you to save for retirement and become financially independent. Even small annual contributions paired with the agency match can make a big difference in your financial future.

Here is an example:

Let’s assume that your base pay is $100,000 per year. You want to save for retirement and take advantage of your agency match. Saving 5% or $5,000 per year will guarantee you another (free) $5,000 in your TSP account. That is a total of $10,000 annually. Assuming a modest return of 7% every year, you will have savings worth $1,000,000 in your TSP in 30 years. (For the 30 years between 1990 and 2019, the US stock market has earned a 9.84% average annual return. By setting aside $150,000 in 30 years, you have the potential of making a million dollars in your retirement. Being patient and consistent in combination with the power of compounding can boost your financial freedom in the long run.

Tax Treatment

For tax purposes, there are two types of individual contributions.

Tax-deferred TSP

Most federal employees opt to make tax-deferred contributions to their Thrift Savings Plan account. These contributions are tax-deductible. They will lower your tax bill for the current tax year. Your TSP investments will grow on a tax-deferred basis. You will only owe federal and state taxes when you start withdrawing your retirement savings.

If you are a uniformed services member making tax-exempt contributions, your contributions will be tax-free; only your earnings will be subject to federal and state tax at withdrawal.

Roth TSP

Roth TSP contributions are pretax. You pay all federal and state taxes before making your contributions. The advantage of Roth TSP is that your retirement savings will grow tax-free. As long as you keep your money until retirement, you will withdraw your investment earnings tax-free. Roth TSP is an excellent alternative for young professionals and federal workers in a low tax bracket.

TSP Fund options

As a TSP participant, you can choose between several fund options.

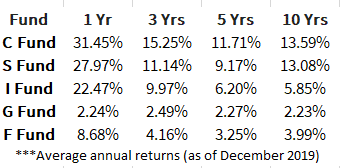

C Fund

The C fund tracks the performance of the S&P 500 Index; a broad market index made up of stocks of the top 500 largest U.S. companies. The C fund owns companies such as Apple, Microsoft, Amazon.com, Facebook, Berkshire Hathaway, JPMorgan Chase, Alphabet, Johnson & Johnson, and Visa. The fund has earned an annualized 13.59% average 10-year rate of return.

S Fund

The S fund matches the performance of the Dow Jones U.S. Completion Total Stock Market Index; a broad market index made up of stocks of small-to-medium size U.S. companies. These are stocks that are not included in the S&P 500 Index. The S fund owns companies like TSLA Tesla Motors, Blackstone Group, Lululemon Athletica, Workday, Splunk, Palo Alto Networks, CoStar Group, Square, Dexcom, and Liberty Broadband Corp. The fund has earned an annualized 13.08% average 10-year rate of return.

I Fund

The I fund invests in foreign stocks and follows the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. The I fund owns companies such as Nestlé, Roche, Novartis, Toyota Motor, HSBC, SAP, Total, AstraZeneca, LVMH, and BP. The fund has earned an annualized 5.85% average 10-year rate of return.

F Fund

The F fund tracks the performance of the Bloomberg Barclays U.S. Aggregate Bond Index. The fund invests in a broad range of US bonds, including US treasuries, investment-grade corporate bonds, and agency mortgage pass-through bonds. Nearly 70% of the fund portfolio is in the highest quality AAA-rated bonds. The fund has earned an annualized 2.23% average 10-year rate of return.

G Fund

The G fund invests in nonmarketable US Treasury bonds specially issued to the TSP. The payment of G Fund principal and interest is guaranteed by the U.S. Government. The G fund is the most stable and safe investment option in the TSP fund list. It has an investment objective to produce a rate of return that is higher than inflation while avoiding market price fluctuations. The fund has earned an annualized 3.99% average 10-year rate of return.

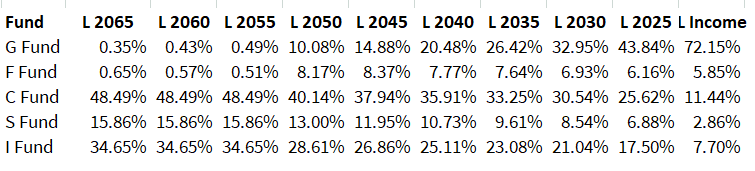

The L Funds

The L funds are lifecycle funds that invest automatically according to a professionally designed mix of stocks, bonds, and government securities. You can select your L Fund based on your age and investment time horizon. Your expected future retirement date will determine which fund assignment. For example, if you plan to retire in 2039, you will be assigned to L 2040 fund.

The L Fund roaster includes L 2065, L 2060, L 2055, L 2050, L 2045, L 2040, L 2035, L 2030, L 2025, and L Income.

All L funds own a mix of the five individual funds. TSP participants with a longer investment horizon will own more stocks and fewer bods. Those approaching retirement will move to a higher allocation to bonds and a smaller allocation to stocks.

Investing your Thrift Savings Plan

The L fund is an easy and convenient investment option. If you choose the lifecycle fund, you do not have to spend too much time guessing the stock market and periodically rebalancing your retirement savings. Your savings will be invested automatically. Your asset allocation will move from more aggressive to more conservative as you get closer to retirement.

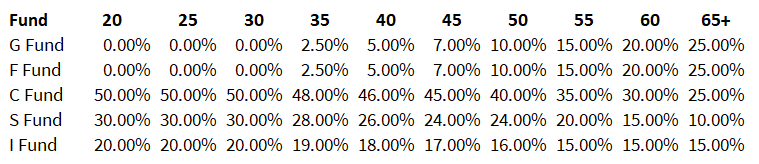

Individual fund mix

If you prefer a more active approach, then you can invest directly in any of the five individual funds. I recommend that you allocate your account depending on your age:

You will notice that my recommendations differ considerably from the current L funds allocation. I established the age-based fund mix based on the actual fund performance and current economic conditions. Before investing, you need to consider your investment horizon, individual circumstances, and risk tolerance level. I assume that younger participants would have a long (30-40 years) investment horizon and high-risk tolerance. On the other hand, participants approaching retirement would have a much shorter investment horizon and lower risk tolerance as they will depend on their retirement savings in the near future. Choosing individual funds gives you the flexibility to make any changes at any point in time.

Plan Your Taxes

Contact Us