What is Tail Risk?

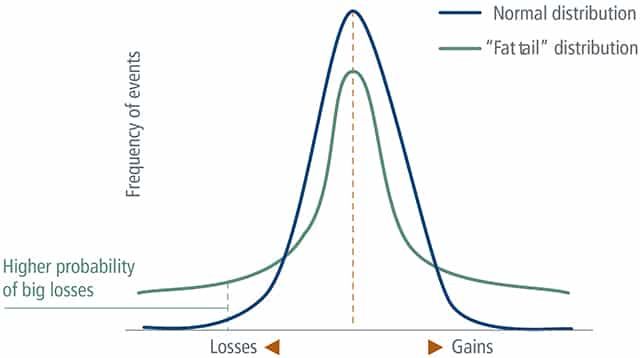

Tail Risk is the possibility of suffering large investment losses due to sudden and unforeseen events. The name tail risk comes from the shape of the bell curve. Under normal circumstances, your most likely investment returns will gravitate in the middle of the curve. For long term investors, this will represent your average expected return. The more extreme returns have a lower probability of occurring and will taper away toward the end of the curve.

The tail on the far-left side represents the probability of unexpected losses. The far-right represents the most extreme outcomes of substantial investment gains. For long-term investors, the ideal portfolio strategy will seek to minimize left tail risk without restricting the right tail growth potential.

Why is tail risk important?

Intuitively, we all want to be on the ride side of the bell curve. We want to achieve above-average returns and occasionally “hit the jackpot” with sizeable gains.

In real life, abrupt economic, social, and geopolitical events appear a lot more frequently than a rational human mind would predict. Furthermore, significant market shocks have been occurring about every three to five years resulting in “fatter” tails.

Also known as “Black Swans, they are rare and unique. These “one-off” events impose adverse pressure on your investment portfolio and create risk for outsized losses. Tail risk events bring a massive amount of financial and economic uncertainty and often lead to extreme turbulence on the stock market.

The Covid outbreak, Brexit, the European credit crisis, the collapse of Lehman Brothers, the Enron scandal, the US housing market downfall, and the 9/11 terrorist attacks are examples of idiosyncratic stock market shocks. Very few experts could have predicted them. More notably, they caused dramatic changes to our society and our economy, our consumer habits, and the way we conduct business.

Assessing your tail risk exposure

Retirees and those close to retirement, people who need immediate liquidity, executives, and employees holding a large amount of corporate stock are more susceptible to tail risk events. If you fall into one of these categories, you need to review your level of risk tolerance.

Investing is risky. There are no truly risk-free investments. There are only investments with different levels of risk. It is impossible to avoid risk altogether. The challenge for you is to have a reasonably balanced approach to all the risks you face. Ignoring one risk to help you prevent another risk does not mean you are in the clear.

Winners and losers

It is important to remember that every shock to the system leads to winners and losers. For example, the covid outbreak disproportionately hurt leisure, travel, retail, energy, and entertainment businesses. But it also benefited many tech companies as it accelerated the digital transformation. As bad as it was, the global financial crisis damaged many big and small regional banks. But it also opened the door for many successful fintech companies such as Visa, Mastercard, PayPal, and Square and exchange-traded fund managers like BlackRock and Vanguard. The aftermath of 9/11 drove the stock market down, but it led to a boost in defense and cybersecurity stocks.

Know your investments

The first step in managing your tail risk is knowing your investments. That is especially important if you have concentrated positions in a specific industry, a cluster of companies, or a single stock. Black Swan events could impact different stocks, sectors, and countries differently. For instance, the Brexit decision mostly hurt the performance of the UK and European companies and had no long-term effect on the US economy.

Know your investment horizon

Investors with a long-term investment horizon are more likely to withstand sudden losses. The stock market is forward-looking. It will absorb the new information, take a hit, and move on.

I always give this as an example. If you invested $1,000 in the S&P 500 index on January 1, 2008, just before the financial crisis, you would have doubled your money in 10 years. Unfortunately, if you needed your investment in one or two years, you would have been in big trouble. It took more than three years to recover your losses entirely.

Diversify

Never put all your eggs in one basket. The most effective way to protect yourself from unexpected losses is diversification. Diversification is the only free lunch you will ever get in investing. It allows you to spread your risk between different companies, sectors, asset classes, and even countries will allow your investment portfolio to avoid choppy swings in various market conditions. One prominent downside of diversification is that while you protect yourself from the left tail risk, you also limit the right tail potential for outsized returns.

Hold cash

Keeping cash reserves is another way to protect yourself from tail risk. You need to have enough liquidity to meet your immediate and near-term spending needs. I regularly advise my clients to maintain an emergency fund equal to six to twelve months of your budget. Put it in a safe place, but make sure that you still earn some interest.

Remember what we said earlier. There is no risk-free investment – even cash. Cash is sensitive to inflation. For instance, $100,000 in 2000 is worth only $66,800 in 2020. So, having a boatload of cash will not guarantee your long-term financial security. You must make it earn a higher return than inflation.

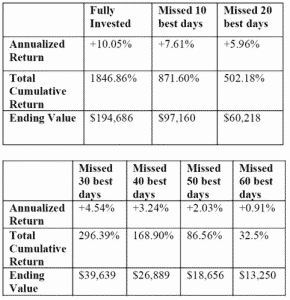

Furthermore, cash has a huge opportunity cost tag. In other words, by holding a large amount of money, you face the risk of missing out on potential gain from choosing other alternatives.

US Treasuries

US Government bonds have historically been a safe haven for investors during turbulent times. We have seen the demand for treasuries spiking during periods of extreme uncertainty and volatility. And inversely, investors tend to drop them when they feel confident about the stock market. Depending on their maturity, US treasuries may give you a slightly higher interest than holding cash in a savings account.

While offering some return potential, treasuries are still exposed to high inflation and opportunity cost risk. Also, government bonds are very sensitive to changes in interest rates. If interest rates go up, the value of your bonds will go down. On the other hand, when interest rates go down, the value of your bonds will decrease.

Gold

Gold is another popular option for conservative investors. Similar to treasuries, the demand for gold tends to go up during uncertain times. The faith for gold stems from its historical role as a currency and store of value. It has been a part of our economic and social life in many cultures for thousands of years.

As we moved away from the Gold standard, the Gold’s role in the economy has diminished over time. Nowadays, the price of gold is purely based on price and demand. One notable fact is that gold tends to perform well during periods of high inflation and political uncertainty.

In his 2011 letter to shareholders of Berkshire Hathaway, Warren Buffet described gold as an “asset that will never produce anything, but that is purchased in the buyer’s hope that someone else … will pay more for them in the future…..If you own one ounce of gold for an eternity, you will still own one ounce at its end.”

Buying Put Options to hedge tail risk

Buying put options om major stock indices is an advanced strategy for tail risk hedging. In essence, an investor will enter into an option agreement for the right to sell a financial instrument at a specified price on a specific day in the future. Typically, this fixed price known as a strike price is lower than the current levels where the instrument is trading. For instance, the stock of XYZ is currently trading at $100. I can buy a put option to sell that stock at $80 three months from now. The option agreement will cost me $2. If the stock price of XYZ goes to $70, I can buy it at $70 and exercise my option to sell it at $80. By doing that, I will have an immediate gain of $10. This is just an illustration. In real life, things can get more complicated.

The real value of buying put options comes during times of extreme overvaluation in the stock market. For the average investor, purchasing put options to tail risk hedging can be expensive, time-consuming, and quite complicated. Most long-term investors will just weather the storm and reap benefits from being patient.

Final words

Managing your tail risk is not a one-size-fits-all strategy. Black Swam events are distinctive in nature, lengh, and magnitude. Because every investor has specific personal and financial circumstances, the left tail risk can affect them differently depending on a variety of factors. For most long-term investors, the left tail and right tail events will offset each other in the long run. However, specific groups of investors need to pay close attention to their unique risk exposure and try to mitigate it when possible.