Tag Retirement Planning

The physician’ roadmap to secure and healthy retirement

I talk to physicians every day and know that retirement is a sensitive subject. For many physicians retiring is an extremely personal decision. And it is not an easy choice to make. You must take into account a wide range…

15 Costly retirement mistakes

15 Costly retirement mistakes… Retirement is a major milestone for many Americans. Retiring marks the end of your working life and the beginning of a new chapter. As a financial advisor, I help my clients avoid mistakes and retire with…

TSP contribution limits 2020

TSP contribution limits for 2020 is 19,500 per person. Additionally, all federal employees over the age of 50 can contribute a catch-up of $6,500 per year. What is TSP? Thrift Saving Plan is a Federal retirement plan where both federal…

IRA Contribution Limits 2020

The IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. What is an IRA? IRA or Traditional IRA is a tax-deferred retirement savings account that allows you…

Roth IRA Contribution Limits 2020

The Roth IRA contribution limits for 2020 are $6,000 per person with an additional $1,000 catch-up contribution for people who are 50 or older. Roth IRA income limits for 2020 Roth IRA contribution limits for 2020 are based on your…

401k contribution limits 2020

401k contribution limits for 2020 are $19,500 per person. All 401k participants over the age of 50 can add a catch-up contribution of $6,500. What is 401k? 401k plan is a workplace retirement plan where both employees and employers can…

Preparing for retirement during coronavirus

Are you preparing for retirement during the coronavirus crisis? Many professionals who are planning to retire in 2020 and beyond are facing unique challenges and circumstances. Probably your investment portfolio took a hit in February and March. Maybe your job…

How to Survive the next Market Downturn

Everything you need to know about surviving the next market downturn: we are in the longest bull market in US history. After more than a decade of record-high stock returns, many investors are wondering if there is another market downturn…

Early retirement for physicians

Early retirement for physicians….As someone married to a physician and surrounded by many friends in the medical field, I know that early retirement is on the minds of many physicians. If you are reading this article, you have probably put…

10 Behavioral biases that can ruin your investments

As a financial advisor, I often speak with my clients about behavioral biases. Our emotions can put a heavy load on our investment decisions. In this article, I would like to discuss ten behavioral biases that I encounter every day.…

The biggest risks for your retirement savings

Whether you are just starting your career or about to retire, you need to understand the risks you are facing when you plan for your future retirement. Most experts recommend that you should aim to replace about 80% of work…

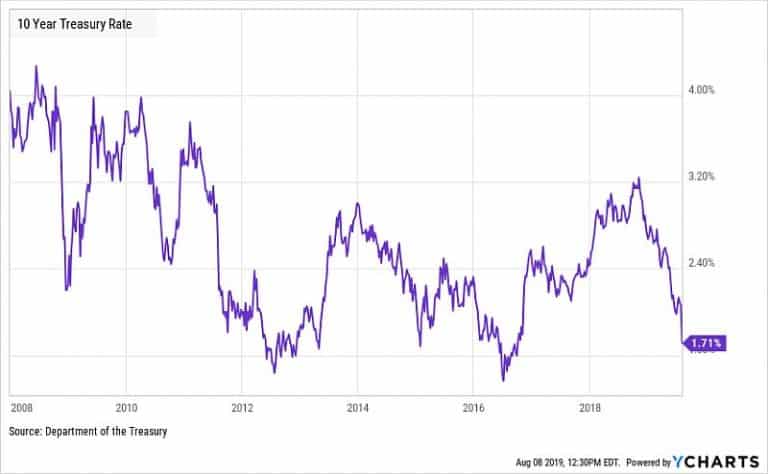

Why negative interest rates are bad for your portfolio

Quantitative Easing Ever since the financial crisis of 2008-2009, central banks around the world have been using lower interest rates and Quantitative Easing (QE) to combat to slow growth and recession fears. In the aftermath of the Great Recession, all…

The Secret to becoming a 401k millionaire

How to become a 401k millionaire? Today, 401k plans are one of the most popular employee benefits. Companies use 401k plans to attract top talent. 401k plan is a powerful vehicle to save for retirement and become financially independent. According…

The Smart Way to Manage Your Sudden Wealth

Getting rich is the dream of many people. When your sudden wealth becomes a reality, you need to be ready for the new responsibilities and challenges. As someone experienced in helping my clients manage their sudden wealth, I want to…

All you need to know about Restricted Stock Units (RSUs)

Restricted Stock Units are a popular equity compensation for both start-up and public companies. Employers, especially many startups, use a variety of compensation options to attract and keep top-performing employees. Receiving RSUs allows employees to share in the ownership and…

A financial checklist for young families

A financial checklist for young families…..Many of my clients are young families looking for help to build their wealth and improve their finances. We typically discuss a broad range of topics from buying a house, saving for retirement, savings for…

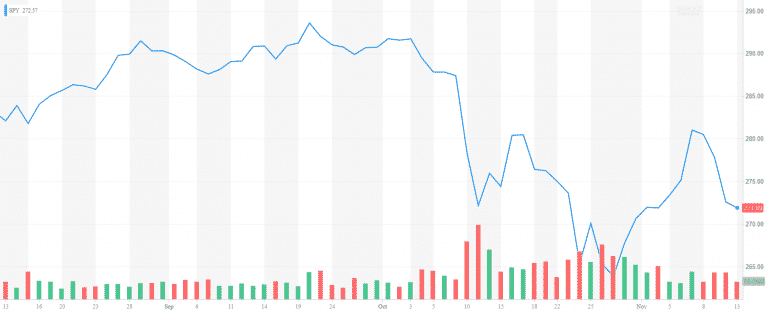

The recent market volatility – the tale of the perfect storm

The recent market volatility – the tale of the perfect storm October is traditionally a rough month for stocks. And October 2018 proved it. S&P 500 went down -6.9% in October after gaining as much as 10.37% in the first…

9 Smart Tax Saving Strategies for High Net Worth Individuals

The Tax Cuts and Jobs Act (TCJA) voted by Congress in late 2017 introduced significant changes to the way high net worth individuals and families file and pay their taxes. The key changes included the doubling of the standard deduction to $12,000…

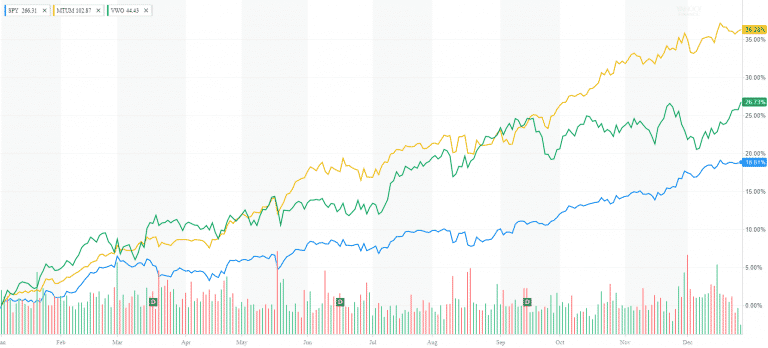

Market Outlook December 2017

Market Outlook December 2017 As we approach 2018, it‘s time to reconcile the past 365 days of 2017. We are sending off a very exciting and tempestuous year. The stock market is at an all-time high. Volatility is at a…

6 Saving & Investment Practices All Business Owners Should Follow

In my practice, I often meet with small business owners who have the entire life savings and family fortune tied up to their company. For many of them, their business is the only way out to retirement. With this post,…

Contact Us