Tax-loss harvesting. How to maximize your after-tax returns.

What is tax-loss harvesting?

Tax-loss harvesting (TLH) is a strategy that you, as an investor, can use to reduce your capital gains taxes and potentially maximize your future after-tax returns. The TLH strategy involves selling an investment in a taxable account at a loss to offset the taxes on another investment sold for a gain in a different part of your investment portfolio. You can only use the strategy in taxable investment accounts.

For example, let’s say you own 1,000 shares of XYZ stock that you bought for $10 per share. The stock is now trading at $8 per share, so you have a loss of $2 per share. You will realize a $2,000 capital loss if you sell the stock.

Tax-loss harvesting can be a great tool to manage taxes and maximize long-term after-tax returns. It can help you reduce risk in your portfolio and turn losses into wins. According to studies, TLH can contribute up to 1% in after-tax portfolio returns.

A well-executed tax loss harvesting strategy can reduce your current tax bill through tax deferral. That means that you are not only saving money on their taxes in a given year, but you can reinvest those tax savings for potential growth in the future. And the longer your portfolio stays invested in the market, the more time it has to grow and compound.

Long-term capital gains versus short-term capital gains

To understand TLH, you also have to know how the US tax system treats long-term versus short-term capital gains

When you buy and sell an asset with appreciated value, you may have to pay capital gains taxes. The amount of tax you owe will depend on how long you hold the asset before selling it. The gain is considered short-term if you own the asset for one year or less. If you hold the investment for more than one year, the gain is taxable as long-term.

Short-term capital gains

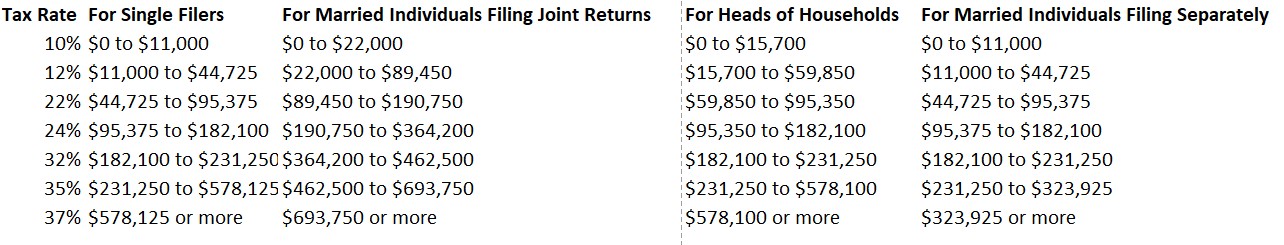

Short-term capital gains are taxable at the same rate as your ordinary income. This means that the higher your income, the higher your capital gains tax rate will be. For example, if you are in the 32% tax bracket, you will pay a 32% capital gains tax on any short-term gains.

Long-term capital gains

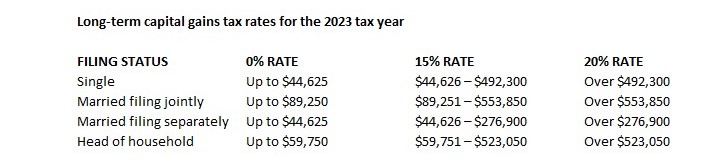

Long-term capital gains, on the other hand, are taxable at a lower rate. The exact rate you pay will depend on your income and filing status.

All else equal, holding an appreciated asset for more than one year before selling it is more financially beneficial if you want to pay lower capital gains taxes.

Keep in mind that income levels to determine the tax rate for long-term capital gains include income from ALL sources, not just capital gains.

Example 1: You are single and earning $150,000 per year. Also, you have reported a long-term capital gain of $25,000. Your reported income is $175,000, which falls in the 15% tax bracket. Therefore, you must pay a long-term capital gain tax of $3,750 ($25,000 x 15%)

Example 2: You are a retired couple filing jointly. You don’t earn any income but have reported $70,000 in long-term capital gains from your investment portfolio. Since your total reportable income is below the 15% tax threshold, you don’t owe any taxes on your investment gains.

There are a few exceptions to the long-term capital gains tax rates. For example, collectibles such as art, antiques, and jewelry are taxed at a flat 28% rate regardless of how long you hold them.

State taxes

Another layer for the full impact of tax loss harvesting is your state taxes. Some states, like Texas and Florida, do not impose taxes on capital gains. California, New York, and New Jersey treat capital gains as ordinary income regardless of your holding period. A third group of states, like Connecticut and North Carolina, have a flat rate. While state income taxes are typically lower than federal ones, it’s essential to understand the full scope of your tax loss harvesting strategy before moving forward.

Net Investment Income tax

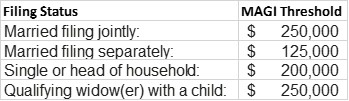

Net investment income tax (NIIT) is a 3.8% surcharge tax on certain types of investment income. It applies to individuals, estates, and trusts with modified adjusted gross income (MAGI) above certain thresholds.

The types of investment income that are subject to NIIT include Interest, Dividends, Capital gains, Rental income, Royalties, Passive income from businesses, and Non-qualified annuities. NIIT does not apply to distributions from retirement accounts, such as IRAs and 401(k)s. Additionally, NIIT does not apply to Social Security benefits, unemployment benefits, or veterans’ benefits.

The MAGI thresholds for NIIT are:

If your MAGI is above the threshold for your filing status, you will owe NIIT on the lesser of your net investment income or the amount by which your MAGI exceeds the threshold.

What are some of the benefits of tax-loss harvesting?

- You can reduce your taxes on capital gains in the current and future tax years.

- Realized capital losses can offset realized capital gains from selling other investments in your portfolio, real estate, private equity, or a business.

- Tax-loss harvesting can help you lower capital gain taxes from selling stocks from employer incentive stock options (ISOs), nonqualified stock options (NSOs), restricted stock units (RSUs), and restricted stock (RS)

- You can unload bad investments

- Turn a loss into a win

- You can deduct up to $3,000 ($1,500 married filing separately) of capital losses per year against ordinary income.

- Any residual losses that exceed $3,000 can be carried forward to future years.

- You can use TLH to diversify your portfolio.

- It can help you take advantage of market fluctuations and rebalance your investment portfolio.

- You can use tax loss harvesting to reduce the risk of holding concentrated positions.

What are some of the risks of tax-loss harvesting?

- You may miss out on future gains if you sell an investment at a loss.

- You may have to repurchase the investment at a higher price in the future.

- TLH may trigger a wash sale if you repurchase your investment too soon.

- You may not be able to offset your losses with gains

Wash Sale Rule

The wash sale rule is an IRS rule that prevents investors from claiming a tax loss on the sale of an investment if they buy the same or substantially identical investment within 30 days before or after the sale. The wash sale rule is designed to prevent investors from artificially inflating their losses in order to reduce their tax liability.

Here is an example of a wash sale:

- You sell 100 shares of ABC stock at a loss of $1,000.

- Within 30 days of selling the ABC stock, you buy 100 shares of DEF, which is substantially identical to ABC.

- You cannot claim the $1,000 loss on the sale of the ABC stock.

- The loss from the sale of ABC shares is deferred for a later date.

- The cost basis of DEF stock will adjust with the amount of the capital loss

The wash sale rule applies to a wide range of investments in a taxable account, including stocks, bonds, mutual funds, and ETFs. It also applies to options and futures contracts. The wash sale rule doesn’t currently apply to cryptocurrency, but that could change in the future.

How to make tax loss harvesting work for you

Here are some of the essential requirements and considerations of a successful tax-loss harvesting strategy

- Stay invested. When you execute tax loss harvesting, you must continue to invest in the market. Replace the asset you sold at a loss with a similar (but not substantially identical) investment. Leaving the proceeds from the sale on the sidelines can lead to a substantial loss of potential future returns.

- Know your goals – tax loss harvesting will be effective only if It is an essential element of your comprehensive financial plan. TLH must be integral to your strategy to achieve your long-term financial goals and milestones.

- Avoid breaking the wash sale rule – Not complying with the wash sale rule can lead to confusion and errors. You may not be able to reach the goals of your TLH strategy if you don’t have a proper execution.

- Know your investment time horizon – If you plan to hold an investment for the long run, it may not be in your best interest to sell it and harvest losses.

- Track your tax bracket – If you are in a higher tax bracket, tax-loss harvesting can be a smart way to reduce your taxes.

- Know the overall health of your portfolio. If your portfolio is well diversified, you may not need to use tax-loss harvesting. However, if your portfolio is concentrated in a few stocks or sectors, tax-loss harvesting can help you reduce your risk.

- Don’t overdo it – too much TLH activity can draw the attention of the IRS or can prompt mistakes.

Final words

Tax-loss harvesting is a complex strategy. And it’s important to understand the risks and benefits before selling investments at a loss. If you are considering tax-loss harvesting, talking to a financial or tax advisor will ensure you know the full implications of the process. A fiduciary advisor can help you tailor a tax-loss harvesting strategy that is right for you and your financial plan.

Contact Us