Tax Saving Moves for 2023: As we approach the end of 2023, I am traditionally sharing my favorite list of tax-saving moves to help you lower your tax bill for 2023. The US tax rules change every year. 2023 was no exception.

2023 has been another challenging year for investors. The interest rates are rising, inflation is stabilizing but still high, and the stock market is volatile as always. Since we don’t have any control over the economy, proactive tax planning is essential for achieving your financial goals. Furthermore, comprehensive financial and tax planning is critical to attaining tax alpha. Making smart tax decisions can help you grow your wealth while you prepare for various outcomes.

Today, you have an excellent opportunity to review your finances. You can make several smart and easy tax moves to lower your tax bill and increase your tax refund. Being ahead of the curve will help you make well-informed decisions without the stress of tax deadlines. Start the conversation today.

Retirement Calculator1. Know your tax bracket

The first step in managing your taxes is knowing your tax bracket. 2023 federal tax rates fall into the following brackets depending on your taxable income and filing status. Knowing where you land on the tax scale can help you make informed decisions, especially when you plan to earn additional income, exercise stock options, or receive RSUs

Here are the Federal tax bracket and rates for 2023.

| Tax Rate | Single Filers | Married Individuals Filing Joint Returns | Heads of Households | Married Individuals Filing Separately |

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 | $0 to $11,000 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $15,700 to $59,850 | $11,000 to $44,725 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $59,850 to $95,350 | $44,725 to $95,375 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,350 to $182,100 | $95,375 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $578,100 | $231,250 to $323,925 |

| 37% | $578,125 or more | $693,750 or more | $578,100 or more | $323,925 or more |

2. Decide to itemize or use a standard deduction

The standard deduction is a specific dollar amount that allows you to reduce your taxable income. Nearly 90% of all tax filers use the standard deduction instead of itemizing. It makes the process a lot simpler for many Americans. However, in some circumstances, your itemized deductions may surpass the dollar amount of the standard deduction and allow you to lower your tax bill even further.

Here are the values for 2023:

| Filing Status | Deduction Amount |

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Head of Household | $20,800 |

3. Maximize your retirement contributions

You can save taxes by contributing to a retirement plan. Most contributions to qualified retirement plans are tax-deductible and lower your tax bill.

- For employees – 401k, 403b, 457, and TSP. The maximum contribution to qualified employee retirement plans for 2023 is $22,500. If you are 50 or older, you can contribute an additional $7,500.

- For business owners – SEP IRA, Solo 401k, and Defined Benefit Plan. Business owners can contribute to SEP IRA, Solo 401k, and Defined Benefit Plans to maximize their retirement savings and lower their tax bills. The maximum contribution to SEP-IRA and Solo 401k in 2023 is $66,000 or $73,500 if you are 50 and older.

If you own a SEP IRA, you can contribute up to 25% of your business wages.

In a solo 401k plan, you can contribute as an employee and an employer. The employee contribution is subject to a $22,500 limit plus a $7,500 catch-up. The employer match is limited to 25% of your compensation for a maximum of $43,500. In many cases, the solo 401k plan can allow you to save more than a SEP IRA.

A defined Benefit Plan is an option for high-income earners who want to save more aggressively for retirement above the SEP-IRA and 401k limits. The DB plan uses actuary rules to calculate your annual contribution limits based on your age and compensation. All contributions to your defined benefit plan are tax-deductible, and the earnings grow tax-free.

4. Roth conversion

Transferring investments from a Traditional IRA or 401k plan to a Roth IRA is known as Roth Conversion. It allows you to switch from tax-deferred to tax-exempt retirement savings.

The conversion amount is taxable for income purposes. The good news is that even though you will pay more taxes in the current year, the conversion may save you a lot more money in the long run.

If you believe your taxes will go up in the future, Roth Conversion could be a very effective way to manage your future taxes.

5. Contribute to a 529 plan

The 529 plan is a tax-advantaged state-sponsored investment plan allowing parents to save for their children’s future college expenses. 529 plan works similarly to the Roth IRA. You make post-tax contributions. Your investment earnings grow free from federal and state income tax if you use them to pay for qualified educational expenses. The 529 plan has a distinct tax advantage compared to a regular brokerage account, as you will never pay taxes on your dividends and capital gains.

Over 30 states offer a full or partial tax deduction or a credit on your 529 contributions. You can find the complete list here. Your 529 contributions can significantly lower your state tax bill if you live in these states.

6. Make a donation

Donations to charities, churches, and various non-profit organizations are tax-deductible. You can support your favorite cause by simultaneously giving back and lowering your tax bill. Your contributions can be in cash, household goods appreciated assets, or directly from your IRA distributions.

Charitable donations are tax-deductible only when you itemize your tax return. If you make small contributions throughout the year, you might be better off taking the standard deduction.

If itemizing your taxes is crucial, you might want to consolidate your donations in one calendar year. So, instead of making multiple charitable contributions over the years, you can give one large donation every few years.

7. Tax-loss harvesting

The stock market is volatile. If you are holding stocks and other investments that dropped significantly in 2023, you can consider selling them. Selling losing investments to reduce your tax liability is known as tax-loss harvesting. It works for capital assets outside retirement accounts (401k, Traditional IRA, and Roth IRA). Capital assets may include real estate, cryptocurrency, cars, gold, stocks, bonds, and any investment property not for personal use.

The IRS allows you to use capital losses to offset capital gains. You can deduct the difference as a loss on your tax return if your capital losses exceed your capital gains. This loss is limited to $3,000 annually or $1,500 if married and filing a separate return. Furthermore, you can carry forward your capital losses for future years and offset future gains.

8. Prioritize long-term over short-term capital gains

Another way to lower your tax bill when selling assets is to prioritize long-term over short-term capital gains. The current tax code benefits investors who keep their assets for more than one calendar year. Long-term investors receive a preferential tax rate on their gains. While investors with short-term capital gains will pay taxes at their ordinary income tax level

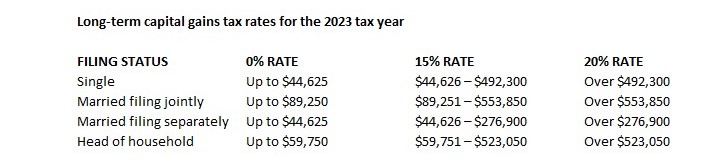

Here are the long-term capital gain tax brackets for 2023:

Furthermore, high-income earners will also pay an additional 3.8% net investment income tax.

9. Contribute to FSA

With healthcare costs constantly increasing, you can use a Flexible Spending Account (FSA) to cover your medical bills and lower your tax bill.

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) is a tax-advantaged savings account offered through your employer. The FSA allows you to save pretax dollars to cover medical and dental expenses for yourself and your dependents.

The maximum contribution for 2023 is $3,050 per person. If you are married, your spouse can save another $3,050 for $6,100 per family. Some employers offer a matching FSA contribution for up to $500. Typically, you must use your FSA savings by the end of the calendar year. However, for 2023, the maximum carryover amount is $610, which you can roll over for the following calendar year.

Dependent Care FSA (DC-FSA)

A Dependent Care FSA is a pretax benefit account that you can use to pay for eligible dependent care services, such as preschool, summer day camp, before or after-school programs, and child or adult daycare. You can reduce your tax bill while taking care of your children and loved ones while you continue working.

The American Rescue Plan Act (ARPA) raised pretax contribution limits for dependent care flexible spending accounts (DC-FSAs) for 2023. For married couples filing jointly or single parents filing as head of household, the maximum contribution limit is $5,000.

10. Buy an electric vehicle

if you purchase an electric car with a final assembly in North America, you might be eligible for a Federal tax credit. Many states have separate incentives. The maximum credit is $7,500, depending on your income, the size of the vehicle, and its battery capacity.

The credit equals:

- $2,917 for a vehicle with a battery capacity of at least 5 kilowatt hours (kWh)

- Plus $417 for each kWh of capacity over 5 kWh

Check the IRS website for the most recent list of vehicles and rules.

11. Contribute to a Health Savings Account (HSA)

A Health Savings Account (HSA) is an investment account for individuals under a High Deductible Health Plan (HDHP) that allows you to save money on a pretax basis to pay for eligible medical expenses.

Keep in mind that the HSA has three distinct tax advantages.

- All HSA contributions are tax-deductible and will lower your tax bill.

- Your investments grow tax-free. You will not pay taxes on dividends, interest, and capital gains.

- You don’t pay taxes on those withdrawals if you use the account for eligible medical expenses.

The qualified High Deductible Plan typically covers only preventive services before the deductible. To qualify for the HSA, the HDHP should have a minimum deductible of $1,500 for an individual and $3,000 for a family. Additionally, your HDHP must have an out-of-pocket maximum of up to $7,500 for one-person coverage or $15,000 for families.

The maximum contributions in HSA for 2023 are $3,850 for individual coverage and $7,750 for families. HSA participants of age 55 or older can contribute an additional $1,000 as a catch-up contribution. Unlike the FSA, the HSA doesn’t have a spending limit, and you can carry over the savings in the next calendar year.

12. Defer or accelerate income

Is 2023 shaping up to be a high income for you? Perhaps you can defer some of your income from this calendar year into 2024. This move will allow you to reduce or delay higher income taxes. Even though it’s not always possible to defer wages, you might be able to postpone a large bonus, royalty, capital gains, option exercise, or one-time payment. Remember, it only makes sense to defer income if you expect to be in a lower tax bracket next year.

On the other hand, if you expect to be in a higher tax bracket next year, you may consider taking as much income as possible in 2023.